Plastic pollution is a critical environmental challenge, compelling governments and organizations worldwide to implement stringent measures to curb its management and impact. In Europe, plastic taxation has become a pivotal strategy to reduce plastic waste and promote recycling.

From the European Union (EU) Plastics Levy and Single-Use Plastics (SUP) Directive 2019/904 to Plastic Packaging Waste Regulations and Plastic Packaging Taxes being introduced by member states, Europe’s legislative landscape is nothing short of a maze and presents challenges for enterprises, especially small-scale businesses to stay ahead of the law with the right data and information systems for compliance.

Categories of Plastic Fees, Levies and Taxes

Plastic taxation in Europe can be categorized into 3 main types:

- Extended Producer Responsibility (EPR) Fees and Licenses: Fees and licenses for waste collection, treatment and recycling of packaging waste, ensuring that producers take responsibility for their products’ end-of-life.

- Plastic and Plastic Packaging Taxes (PPT): Taxes on plastic products and packaging to incentivize use of recycled content and reduce waste.

- Single-Use Plastics (SUP) Management Fees: Charges for cleaning up and processing litter from plastic packaging items categorized as single-use, to encourage responsible disposal and reduce its environmental impact.

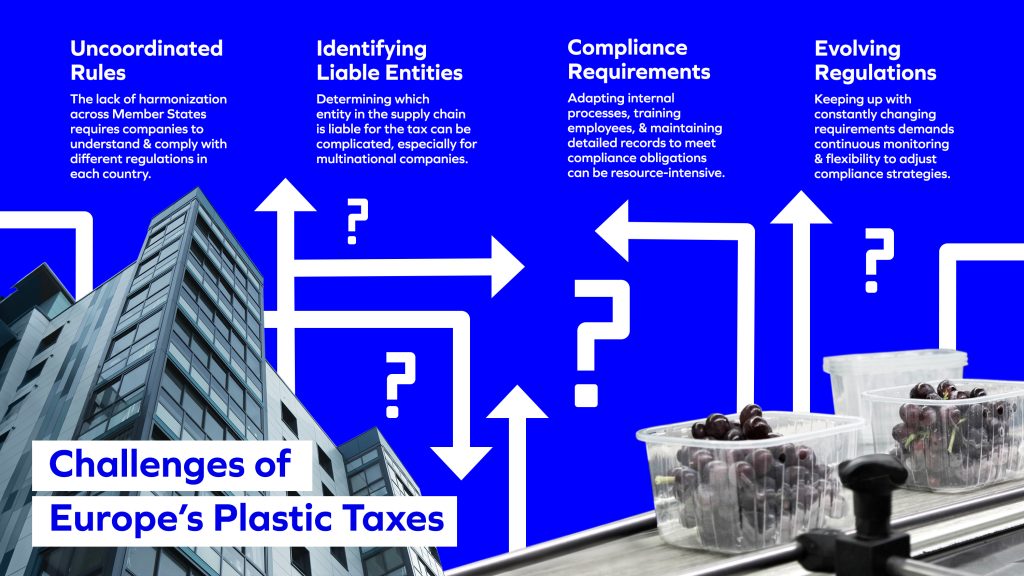

Challenges for Enterprises

Navigating the complex landscape of plastic taxation poses several challenges for businesses:

- Uncoordinated Rules: The lack of harmonization across Member States requires companies to understand and comply with different regulations in each country.

- Identifying Liable Entities: Determining which entity in the supply chain is liable for the tax can be complicated, especially for multinational companies.

- Compliance Requirements: Adapting internal processes, training employees, and maintaining detailed records to meet compliance obligations can be resource-intensive.

- Evolving Regulations: Keeping up with constantly changing requirements demands continuous monitoring and flexibility to adjust compliance strategies.

Experiences in the UK and Spain

United Kingdom: The UK introduced the Plastic Packaging Tax (PPT) on April 1, 2022, targeting plastic packaging with less than 30% recycled content. The tax rate is GBP 200 per tonne of plastic packaging. Businesses must register for the tax, maintain records, and submit quarterly returns. The UK has also implemented a penalty regime for non-compliance, including fines and interest charges. This proactive approach has encouraged companies to increase the use of recycled materials and improve their environmental footprint.

Spain: Spain implemented the Plastic Packaging Tax on January 1, 2023, with a tax rate of EUR 0.45 per kilogram of non-reusable plastic packaging. Similar to the UK, Spanish businesses must register, keep detailed records, and file quarterly returns. The Spanish government has introduced penalties for non-compliance, reinforcing the importance of adhering to the new regulations. The tax has spurred innovations in packaging design and increased the adoption of sustainable materials.

Delays in Germany and Italy

Germany: Germany planned to introduce a national plastic tax in 2025 but has faced delays due to challenges in data collection and concerns over excessive bureaucracy. The German government is working to finalize a practical model for the tax, considering postponing its introduction to 2026. These delays highlight the complexity of implementing new taxation systems and the need for robust infrastructure to support compliance.

Italy: Italy’s Plastic Packaging Tax (PPT) was initially set to take effect in 2024 but has been postponed to January 1, 2026. The delay is attributed to the need for more time to develop an efficient, low-bureaucracy solution and assess the economic impacts. Stakeholder feedback and the potential burden on small and medium-sized enterprises have also influenced the decision to delay the implementation.

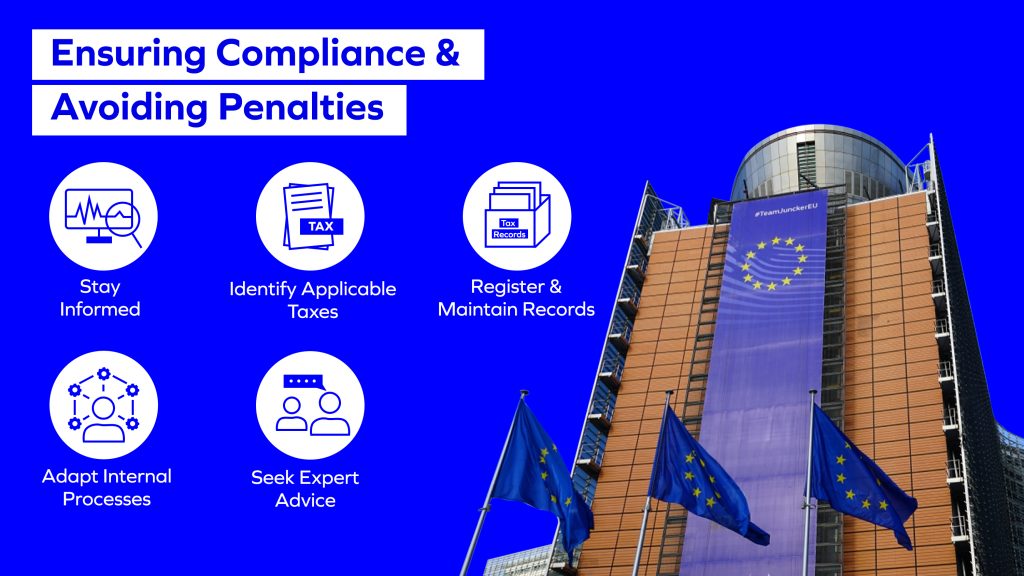

Ensuring Compliance and Avoiding Penalties

Staying ahead of the plastic taxation legislations requires a sound understanding of the interaction between EU level and Member State plastic taxes and EPR compliance. For effective navigation, businesses should adopt proactive strategies:

- Stay Informed: Regularly monitor legislative changes and updates to ensure compliance with the latest regulations.

- Identify Applicable Taxes: Determine which taxes apply to your products and operations in each Member State.

- Register and Maintain Records: Ensure timely registration for applicable taxes, maintain detailed records, and file accurate tax returns.

- Adapt Internal Processes: Implement internal controls, train employees, and establish monitoring and reporting mechanisms

- Seek Expert Advice: Consult with tax and legal experts to develop efficient tax strategies and avoid unnecessary costs.

Plastic taxation in Europe is now a crucial component of the broader strategy to reduce plastic waste and promote sustainability. While it presents challenges for businesses, proactive planning, and compliance strategies can help mitigate risks and ensure adherence to regulations. Navigating the hurricane of laws and regulations is crucial for all connected businesses, all in the best interest of doing good for people and the planet.

Great content, thanks for posting.

Saved as a favorite, I really like your blog!

Do you have a spam issue on this site; I also am a blogger, and I was curious about your situation; we have developed some nice methods and we are looking to exchange strategies with other folks, why not shoot me an email if interested.

новости сегодня

Exodermin y su acción hidratante en la piel afectada

La hidratación es esencial para mantener la belleza de la dermis.

Muchas personas, en su búsqueda por restaurar la vitalidad

de su rostro, descubren opciones innovadoras. En este contexto, hay productos

formulados para brindar ese alivio tan necesario. Pero, ¿realmente funcionan? La

respuesta depende de los componentes que cada uno posee.

La sensación de sequedad puede resultar incómoda y antiestética.

Con el tiempo, la falta de humedad provoca que la superficie se

vea apagada. Además, genera la aparición de líneas

y arrugas. Esto puede ser frustrante y, a menudo, ataca la confianza en uno mismo.

Para aquellos que buscan soluciones, formularios avanzados

prometen resultados visibles. Al combinar ingredientes naturales

y tecnología moderna, se logran efectos sorprendentes.

Aunque parezca un desafío encontrar el producto adecuado, es posible.

La clave está en comprender cómo cada elemento actúa en nuestro organismo.

Uno de los beneficios más destacados de estos exclusivos preparados es su capacidad

para restaurar y reafirmar el tejido, ofreciendo una renovación profunda y notable.

La combinación precisa de elementos activos no solo proporciona

una sensación de frescura, sino que también impulsa la regeneración celular, permitiendo que la superficie luzca

radiante y saludable. Por lo tanto, es fundamental elegir sabiamente y entender cómo funciona

cada componente.

Conocer la manera en que interactúan estos tratamientos con nuestras necesidades es indispensable.

El cuidado apropiado transformará la experiencia diaria.

Con el tiempo, se puede lograr un efecto acumulativo que se traduce en un impacto duradero.

Al final, la satisfacción y el bienestar son lo que realmente buscamos.

Efectividad en la hidratación cutánea

Cuando se trata de mantener la dermis en óptimas condiciones, es esencial

contar con un aliado eficaz. Existen productos que no solo proporcionan una sensación de frescura, sino que también nutren profundamente.

La capacidad de restaurar y revitalizar es fundamental para el bienestar.

Aquí, la innovación juega un papel crucial, permitiendo que la gente disfrute de resultados visibles en poco

tiempo.

Es interesante notar que ciertos compuestos naturales

potencian la humectación de la superficie. Con cada aplicación,

se pueden observar cambios significativos. Esa es una de las claves del éxito:

la fórmula seleccionada. Además, el equilibrio entre la saturación y la pérdida de agua se

convierte en el objetivo primordial, y, por ende, se busca una solución que favorezca ese proceso.

Lo que muchos buscan es un producto que no sea grasoso, que penetre

rápidamente y brinde alivio inmediato. La textura juega un papel importante en esto.

Además, la sensación después de su uso puede ser sorprendentemente placentera,

lo que invita a aplicarlo regularmente. Algunos usuarios han comentado que desde la primera aplicación notaron una diferencia notable, lo que

genera expectativas sobre el uso a largo plazo.

Por lo tanto, la eficacia no radica únicamente en el primer impacto, sino en la capacidad de mantener

la mejora con el tiempo. La combinación de ingredientes

activos permite abordar múltiples problemas que pueden surgir.

Desde la sequedad hasta pequeñas irritaciones, se convierten en parte del pasado

cuando se implementa uno de estos innovadores productos.

Así es como, poco a poco, se establece una rutina que beneficia no

solo la estética sino también la salud dérmica.

Beneficios para la dermis dañada

El uso de ciertos productos puede transformar significativamente la salud de la superficie externa.

Cuando la dermis sufre daños, es fundamental contar con una solución efectiva que ayude a repararla y revitalizarla.

Estos productos tienen la capacidad de nutrir la zona comprometida.

Además, aportan propiedades que facilitan una recuperación más rápida.

Esto se traduce en una apariencia más saludable y radiante.

Uno de los grandes ventajas es su potenciación de la

regeneración celular. La renovación de las células es crucial para restaurar el brillo

natural. El suavizado de las texturas irregulares también se vuelve evidente poco a poco.

A medida que avanzamos en el tratamiento, se nota una disminución del enrojecimiento y la irritación. Esto no solo mejora la estética, sino que también genera confianza en quienes lo utilizan.

Las propiedades que poseen estos productos abarcan una gama amplia de beneficios.

Por ejemplo, forman una barrera que protege de agresores externos.

Esto, a su vez, minimiza la posibilidad de futuras complicaciones.

Con el tiempo, estos compuestos se instalan en la epidermis, ofreciendo

un efecto prolongado. Es como un abrazo reconfortante para la zona comprometida.

Adicionalmente, la sensación de alivio que se

experimenta es inmediata. La hidratación profunda y constante calma cualquier malestar existente.

A través de su aplicación regular, los resultados se van consolidando, convirtiéndose en parte

de la rutina diaria. La satisfacción que brinda cuidar de

uno mismo es incomparable, y el uso adecuado de estos productos lo hace posible.

precio de exodermin

https://rekforum.ru/viewtopic.php?t=46795

fap porno

кракен tor

кракен login

кракен onion

kraken тор браузер

kraken market

kraken mirror

kraken ссылка

кракен

сайт kraken даркнет

kraken зеркало

кракен даркнет маркет

kraken tor

кракен даркнет маркет

kraken даркнет маркет

kraken зайти

кракен рабочее зеркало

kraken обход блокировки

кракен зайти

кракен onion

kraken актуальная ссылка

кракен darknet market

kraken сайт

кракен тор браузер

кракен ссылка

кракен тор браузер

кракен маркет

кракен ссылка tor

kraken даркнет

kraken login

kraken даркнет маркет

кракен вход

kraken даркнет маркет

кракен tor зеркало

kraken актуальная ссылка

кракен link

кракен официальный сайт

kraken официальный сайт

kraken рабочее зеркало

кракен ссылка tor

кракен market

кракен market

kraken

kraken tor зеркало

кракен зеркало

kraken зеркало

kraken onion

кракен сайт

kraken onion

кракен ссылка tor

кракен onion

как зайти на кракен даркнет

kraken рабочее зеркало

kraken официальный сайт

кракен актуальная ссылка

kraken ссылка

кракен market

kraken вход

kraken даркнет маркет

kraken darknet market

кракен зайти

кракен tor зеркало

kraken market

кракен ссылка tor

kraken tor зеркало

kraken darknet tor

кракен mirror

hello there and thanks for your information – I have certainly picked up anything new from right here. I did alternatively expertise some technical points the usage of this website, as I experienced to reload the web site many instances previous to I could get it to load properly. I had been brooding about if your web hosting is OK? No longer that I am complaining, but slow loading instances occasions will sometimes impact your placement in google and can injury your quality score if advertising and ***********|advertising|advertising|advertising and *********** with Adwords. Anyway I’m including this RSS to my e-mail and can glance out for much more of your respective interesting content. Ensure that you update this once more very soon..

Actually, I had to find Zithromax quickly and discovered Antibiotics Express. It allows you to purchase generics online securely. In case of strep throat, this is the best place. Fast shipping to USA. More info: purchase zithromax. Good luck.

Lately, I needed antibiotics urgently and found a reliable pharmacy. They let you get treatment fast safely. If you have a bacterial infection, try here. Express delivery available. Check it out: purchase zithromax. Get well soon.

Lately, I had to buy Amoxicillin for a toothache and came across Amoxicillin Express. They sell effective treatment overnight. If you are in pain, this is the best place: buy amoxicillin online. Cheers.

Bocoran slot gacor malam ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Situs ini gampang menang dan resmi. Bonus new member menanti anda. Akses link: п»їhttps://bonaslotind.us.com/# Bonaslot login raih kemanangan.

Yeni Pin Up giriş ünvanını axtarırsınızsa, doğru yerdesiniz. İşlək link vasitəsilə qeydiyyat olun və oynamağa başlayın. Xoş gəldin bonusu sizi gözləyir. Keçid: Pin Up giriş qazancınız bol olsun.

2026 yılında en çok kazandıran casino siteleri hangileri? Detaylı liste platformumuzda mevcuttur. Deneme bonusu veren siteleri ve yeni adres linklerini paylaşıyoruz. Hemen tıklayın https://cassiteleri.us.org/# kaçak bahis siteleri fırsatı kaçırmayın.

Pin Up Casino ölkəmizdə ən populyar kazino saytıdır. Saytda minlərlə oyun və canlı dilerlər var. Qazancı kartınıza anında köçürürlər. Proqramı də var, telefondan oynamaq çox rahatdır. Giriş linki burada baxın.

Pin-Up AZ ölkəmizdə ən populyar platformadır. Saytda minlərlə oyun və Aviator var. Qazancı kartınıza anında köçürürlər. Proqramı də var, telefondan oynamaq çox rahatdır. Giriş linki Pin Up rəsmi sayt baxın.

Salamlar, siz də yaxşı kazino axtarırsınızsa, məsləhətdir ki, Pin Up saytını yoxlayasınız. Canlı oyunlar və rahat pul çıxarışı burada mövcuddur. İndi qoşulun və ilk depozit bonusunu götürün. Daxil olmaq üçün link: Pin Up uğurlar hər kəsə!

Selamlar, ödeme yapan casino siteleri arıyorsanız, hazırladığımız listeye kesinlikle göz atın. Lisanslı firmaları ve fırsatları sizin için listeledik. Güvenli oyun için doğru adres: casino siteleri bol şanslar.

Bocoran slot gacor hari ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Situs ini anti rungkad dan resmi. Bonus new member menanti anda. Kunjungi: п»їslot gacor raih kemanangan.

Yeni Pin Up giriş ünvanını axtaranlar, doğru yerdesiniz. Bloklanmayan link vasitəsilə qeydiyyat olun və qazanmağa başlayın. Pulsuz fırlanmalar sizi gözləyir. Keçid: https://pinupaz.jp.net/# Pin Up online uğurlar.

Bu sene en çok kazandıran casino siteleri hangileri? Cevabı web sitemizde mevcuttur. Bedava bahis veren siteleri ve yeni adres linklerini paylaşıyoruz. İncelemek için https://cassiteleri.us.org/# mobil ödeme bahis kazanmaya başlayın.

Yeni Pin Up giriş ünvanını axtarırsınızsa, bura baxa bilərsiniz. İşlək link vasitəsilə qeydiyyat olun və oynamağa başlayın. Pulsuz fırlanmalar sizi gözləyir. Keçid: https://pinupaz.jp.net/# Pin Up kazino hamıya bol şans.

Yeni Pin Up giriş ünvanını axtaranlar, bura baxa bilərsiniz. Bloklanmayan link vasitəsilə hesabınıza girin və qazanmağa başlayın. Pulsuz fırlanmalar sizi gözləyir. Keçid: Pin Up online uğurlar.

2026 yılında en çok kazandıran casino siteleri hangileri? Cevabı web sitemizde mevcuttur. Bedava bahis veren siteleri ve güncel giriş linklerini paylaşıyoruz. İncelemek için https://cassiteleri.us.org/# mobil ödeme bahis kazanmaya başlayın.

Selamlar, ödeme yapan casino siteleri arıyorsanız, hazırladığımız listeye kesinlikle göz atın. Lisanslı firmaları ve bonusları sizin için listeledik. Dolandırılmamak için doğru adres: https://cassiteleri.us.org/# listeyi gör bol şanslar.

п»їHalo Slotter, lagi nyari situs slot yang gacor? Rekomendasi kami adalah Bonaslot. RTP Live tertinggi hari ini dan terbukti membayar. Isi saldo bisa pakai Pulsa tanpa potongan. Daftar sekarang: п»їhttps://bonaslotind.us.com/# Bonaslot link alternatif semoga maxwin.

Info slot gacor hari ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Website ini anti rungkad dan resmi. Bonus new member menanti anda. Kunjungi: https://bonaslotind.us.com/# bonaslotind.us.com dan menangkan.

Pin-Up AZ Azərbaycanda ən populyar platformadır. Burada minlərlə oyun və canlı dilerlər var. Pulu kartınıza tez köçürürlər. Proqramı də var, telefondan oynamaq çox rahatdır. Rəsmi sayt https://pinupaz.jp.net/# Pin Up rəsmi sayt baxın.

Halo Bosku, lagi nyari situs slot yang hoki? Rekomendasi kami adalah Bonaslot. RTP Live tertinggi hari ini dan terbukti membayar. Deposit bisa pakai Pulsa tanpa potongan. Daftar sekarang: situs slot resmi salam jackpot.

Canlı casino oynamak isteyenler için rehber niteliğinde bir site: https://cassiteleri.us.org/# casino siteleri 2026 Hangi site güvenilir diye düşünmeyin. Editörlerimizin seçtiği casino siteleri listesi ile rahatça oynayın. Detaylar linkte.

Canlı casino oynamak isteyenler için kılavuz niteliğinde bir site: bonus veren siteler Hangi site güvenilir diye düşünmeyin. Onaylı bahis siteleri listesi ile rahatça oynayın. Detaylar linkte.

Canlı casino oynamak isteyenler için kılavuz niteliğinde bir site: https://cassiteleri.us.org/# listeyi gör Hangi site güvenilir diye düşünmeyin. Onaylı casino siteleri listesi ile rahatça oynayın. Tüm liste linkte.

Pin-Up AZ ölkəmizdə ən populyar kazino saytıdır. Burada minlərlə oyun və Aviator var. Qazancı kartınıza tez köçürürlər. Mobil tətbiqi də var, telefondan oynamaq çox rahatdır. Giriş linki Pin Up AZ baxın.

Canlı casino oynamak isteyenler için kılavuz niteliğinde bir site: bonus veren siteler Hangi site güvenilir diye düşünmeyin. Editörlerimizin seçtiği bahis siteleri listesi ile rahatça oynayın. Detaylar linkte.

Pin-Up AZ Azərbaycanda ən populyar kazino saytıdır. Burada minlərlə oyun və canlı dilerlər var. Pulu kartınıza anında köçürürlər. Proqramı də var, telefondan oynamaq çox rahatdır. Rəsmi sayt https://pinupaz.jp.net/# pinupaz.jp.net yoxlayın.

HÉ™r vaxtınız xeyir, É™gÉ™r siz etibarlı kazino axtarırsınızsa, mÉ™slÉ™hÉ™tdir ki, Pin Up saytını yoxlayasınız. Æn yaxşı slotlar vÉ™ rahat pul çıxarışı burada mövcuddur. Qeydiyyatdan keçin vÉ™ bonus qazanın. Daxil olmaq üçün link: sayta keçid uÄŸurlar hÉ™r kÉ™sÉ™!

Salam dostlar, siz dÉ™ keyfiyyÉ™tli kazino axtarırsınızsa, mÉ™slÉ™hÉ™tdir ki, Pin Up saytını yoxlayasınız. Æn yaxşı slotlar vÉ™ rahat pul çıxarışı burada mövcuddur. Ä°ndi qoÅŸulun vÉ™ ilk depozit bonusunu götürün. Oynamaq üçün link: sayta keçid uÄŸurlar hÉ™r kÉ™sÉ™!

Bu sene popüler olan casino siteleri hangileri? Cevabı web sitemizde mevcuttur. Deneme bonusu veren siteleri ve yeni adres linklerini paylaşıyoruz. İncelemek için https://cassiteleri.us.org/# mobil ödeme bahis fırsatı kaçırmayın.

2026 yılında en çok kazandıran casino siteleri hangileri? Detaylı liste platformumuzda mevcuttur. Bedava bahis veren siteleri ve güncel giriş linklerini paylaşıyoruz. İncelemek için casino siteleri 2026 fırsatı kaçırmayın.

Yeni Pin Up giriş ünvanını axtaranlar, doğru yerdesiniz. İşlək link vasitəsilə hesabınıza girin və oynamağa başlayın. Pulsuz fırlanmalar sizi gözləyir. Keçid: https://pinupaz.jp.net/# Pin Up giriş uğurlar.

Info slot gacor malam ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Website ini gampang menang dan aman. Bonus new member menanti anda. Akses link: п»їhttps://bonaslotind.us.com/# Bonaslot raih kemanangan.

Canlı casino oynamak isteyenler için rehber niteliğinde bir site: https://cassiteleri.us.org/# bonus veren siteler Nerede oynanır diye düşünmeyin. Editörlerimizin seçtiği bahis siteleri listesi ile sorunsuz oynayın. Tüm liste linkte.

Salam Gacor, cari situs slot yang hoki? Coba main di Bonaslot. Winrate tertinggi hari ini dan terbukti membayar. Deposit bisa pakai Pulsa tanpa potongan. Login disini: Bonaslot link alternatif salam jackpot.

Selam, sağlam casino siteleri bulmak istiyorsanız, hazırladığımız listeye mutlaka göz atın. En iyi firmaları ve bonusları sizin için inceledik. Dolandırılmamak için doğru adres: siteyi incele bol şanslar.

Pin-Up AZ ölkəmizdə ən populyar platformadır. Burada çoxlu slotlar və canlı dilerlər var. Qazancı kartınıza tez köçürürlər. Proqramı də var, telefondan oynamaq çox rahatdır. Rəsmi sayt https://pinupaz.jp.net/# Pin-Up Casino tövsiyə edirəm.

Salamlar, əgər siz etibarlı kazino axtarırsınızsa, mütləq Pin Up saytını yoxlayasınız. Canlı oyunlar və rahat pul çıxarışı burada mövcuddur. Qeydiyyatdan keçin və bonus qazanın. Sayta keçmək üçün link: Pin-Up Casino uğurlar hər kəsə!

Bonaslot adalah agen judi slot online nomor 1 di Indonesia. Ribuan member sudah mendapatkan Jackpot sensasional disini. Transaksi super cepat hanya hitungan menit. Link alternatif п»їhttps://bonaslotind.us.com/# bonaslotind.us.com jangan sampai ketinggalan.

Aktual Pin Up giriş ünvanını axtaranlar, bura baxa bilərsiniz. İşlək link vasitəsilə qeydiyyat olun və oynamağa başlayın. Pulsuz fırlanmalar sizi gözləyir. Keçid: Pin-Up Casino hamıya bol şans.

Halo Slotter, cari situs slot yang gacor? Coba main di Bonaslot. Winrate tertinggi hari ini dan pasti bayar. Deposit bisa pakai Dana tanpa potongan. Daftar sekarang: Bonaslot link alternatif semoga maxwin.

Hər vaxtınız xeyir, əgər siz keyfiyyətli kazino axtarırsınızsa, məsləhətdir ki, Pin Up saytını yoxlayasınız. Yüksək əmsallar və rahat pul çıxarışı burada mövcuddur. İndi qoşulun və ilk depozit bonusunu götürün. Oynamaq üçün link: ətraflı məlumat uğurlar hər kəsə!

Pin Up Casino ölkəmizdə ən populyar platformadır. Burada çoxlu slotlar və canlı dilerlər var. Qazancı kartınıza tez köçürürlər. Mobil tətbiqi də var, telefondan oynamaq çox rahatdır. Giriş linki rəsmi sayt tövsiyə edirəm.

Salamlar, siz də etibarlı kazino axtarırsınızsa, məsləhətdir ki, Pin Up saytını yoxlayasınız. Yüksək əmsallar və rahat pul çıxarışı burada mövcuddur. İndi qoşulun və bonus qazanın. Daxil olmaq üçün link: Pinup uğurlar hər kəsə!

п»їHalo Bosku, cari situs slot yang gacor? Rekomendasi kami adalah Bonaslot. Winrate tertinggi hari ini dan terbukti membayar. Isi saldo bisa pakai OVO tanpa potongan. Daftar sekarang: п»їsitus slot resmi salam jackpot.

Bonaslot adalah agen judi slot online nomor 1 di Indonesia. Banyak member sudah mendapatkan Jackpot sensasional disini. Proses depo WD super cepat kilat. Situs resmi https://bonaslotind.us.com/# Bonaslot link alternatif jangan sampai ketinggalan.

Canlı casino oynamak isteyenler için rehber niteliğinde bir site: https://cassiteleri.us.org/# türkçe casino siteleri Nerede oynanır diye düşünmeyin. Editörlerimizin seçtiği bahis siteleri listesi ile sorunsuz oynayın. Detaylar linkte.

Situs Bonaslot adalah agen judi slot online terpercaya di Indonesia. Banyak member sudah merasakan Maxwin sensasional disini. Proses depo WD super cepat hanya hitungan menit. Situs resmi Bonaslot link alternatif jangan sampai ketinggalan.

Selamlar, ödeme yapan casino siteleri arıyorsanız, bu siteye mutlaka göz atın. En iyi firmaları ve bonusları sizin için listeledik. Güvenli oyun için doğru adres: güvenilir casino siteleri iyi kazançlar.

Bonaslot adalah agen judi slot online terpercaya di Indonesia. Banyak member sudah merasakan Jackpot sensasional disini. Proses depo WD super cepat kilat. Situs resmi п»їslot gacor gas sekarang bosku.

Aktual Pin Up giriş ünvanını axtaranlar, bura baxa bilərsiniz. Bloklanmayan link vasitəsilə qeydiyyat olun və oynamağa başlayın. Pulsuz fırlanmalar sizi gözləyir. Keçid: https://pinupaz.jp.net/# Pin Up qazancınız bol olsun.

Yeni Pin Up giriş ünvanını axtarırsınızsa, doğru yerdesiniz. İşlək link vasitəsilə qeydiyyat olun və oynamağa başlayın. Pulsuz fırlanmalar sizi gözləyir. Keçid: Pin Up yüklə uğurlar.

Bu sene popüler olan casino siteleri hangileri? Cevabı platformumuzda mevcuttur. Bedava bahis veren siteleri ve yeni adres linklerini paylaşıyoruz. İncelemek için güvenilir casino siteleri fırsatı kaçırmayın.

Merhaba arkadaşlar, güvenilir casino siteleri arıyorsanız, bu siteye kesinlikle göz atın. En iyi firmaları ve bonusları sizin için inceledik. Güvenli oyun için doğru adres: canlı casino siteleri iyi kazançlar.

Hər vaxtınız xeyir, siz də yaxşı kazino axtarırsınızsa, mütləq Pin Up saytını yoxlayasınız. Yüksək əmsallar və sürətli ödənişlər burada mövcuddur. Qeydiyyatdan keçin və ilk depozit bonusunu götürün. Sayta keçmək üçün link: Pinup uğurlar hər kəsə!

Salamlar, siz də etibarlı kazino axtarırsınızsa, mütləq Pin Up saytını yoxlayasınız. Yüksək əmsallar və sürətli ödənişlər burada mövcuddur. Qeydiyyatdan keçin və ilk depozit bonusunu götürün. Oynamaq üçün link: Pin Up uğurlar hər kəsə!

Pin Up Casino ölkəmizdə ən populyar kazino saytıdır. Saytda minlərlə oyun və canlı dilerlər var. Qazancı kartınıza anında köçürürlər. Proqramı də var, telefondan oynamaq çox rahatdır. Rəsmi sayt https://pinupaz.jp.net/# bura daxil olun baxın.

Selamlar, güvenilir casino siteleri bulmak istiyorsanız, bu siteye kesinlikle göz atın. En iyi firmaları ve bonusları sizin için listeledik. Dolandırılmamak için doğru adres: cassiteleri.us.org bol şanslar.

Bu sene popüler olan casino siteleri hangileri? Detaylı liste platformumuzda mevcuttur. Deneme bonusu veren siteleri ve yeni adres linklerini paylaşıyoruz. İncelemek için en iyi casino siteleri kazanmaya başlayın.

Salam Gacor, cari situs slot yang hoki? Rekomendasi kami adalah Bonaslot. RTP Live tertinggi hari ini dan terbukti membayar. Isi saldo bisa pakai Dana tanpa potongan. Daftar sekarang: Bonaslot salam jackpot.

Greetings, I recently discovered an excellent online drugstore for purchasing medications hassle-free. For those who need antibiotics, OnlinePharm is very good. Fast delivery plus huge selection. Check it out: visit website. Cya.

To be honest, I just found a reliable resource to buy medication. If you want to save money and need meds from Mexico, Pharm Mex is highly recommended. No prescription needed plus very reliable. Check it out: https://pharm.mex.com/#. Good luck!

Hey there, I just came across an awesome Mexican pharmacy to buy medication. If you are tired of high prices and want meds from Mexico, this store is the best option. Great prices and very reliable. Take a look: https://pharm.mex.com/#. Take care.

Hello, To be honest, I found a reliable online drugstore for purchasing generics online. If you need cheap meds, this site is very good. Great prices and huge selection. See for yourself: Online Pharm Store. Cheers.

Hi all, Just now found the best Indian pharmacy to buy generics. If you want to buy medicines from India cheaply, this store is worth checking. You get lowest prices to USA. More info here: https://indiapharm.in.net/#. Best regards.

Hey there, I wanted to share a reliable international pharmacy for purchasing prescription drugs securely. For those who need safe pharmacy delivery, this store is the best choice. Great prices and no script needed. Link here: read more. Thank you.

Greetings, Lately ran into an awesome Mexican pharmacy to save on Rx. If you are tired of high prices and need generic drugs, this site is highly recommended. Great prices plus very reliable. Check it out: cheap antibiotics mexico. Good luck with everything.

Hello, I wanted to share a reliable website where you can buy generics online. If you are looking for antibiotics, this store is highly recommended. Fast delivery and it is very affordable. Check it out: cheap pharmacy online. Thanks!

Hi, To be honest, I found a great source for meds for purchasing generics cheaply. For those who need cheap meds, this store is worth a look. They ship globally plus huge selection. Visit here: check availability. Appreciate it.

Hey there, Lately came across a great Mexican pharmacy for affordable pills. If you are tired of high prices and need cheap antibiotics, Pharm Mex is a game changer. Great prices plus it is safe. Check it out: Pharm Mex. Be well.

Hey there, Just now ran into a reliable Mexican pharmacy to save on Rx. For those seeking and need meds from Mexico, this site is highly recommended. They ship to USA plus secure. Take a look: https://pharm.mex.com/#. Thanks!

Hello everyone, Lately found a great website for cheap meds. For those seeking and need meds from Mexico, this site is a game changer. Fast shipping plus very reliable. Check it out: https://pharm.mex.com/#. Regards.

Hey there, I wanted to share a useful source for meds where you can buy medications cheaply. If you need no prescription drugs, this site is very good. Fast delivery plus no script needed. Check it out: international pharmacy online. Stay safe.

Hey there, I recently discovered a great online drugstore where you can buy medications cheaply. If you are looking for no prescription drugs, OnlinePharm is the best choice. Fast delivery and no script needed. Visit here: online pharmacy usa. Thank you.

Hey there, I wanted to share a great website for purchasing medications securely. For those who need no prescription drugs, this site is very good. Fast delivery plus huge selection. See for yourself: https://onlinepharm.jp.net/#. Hope it helps.

Hello, I just discovered the best Indian pharmacy to save on Rx. For those looking for cheap antibiotics at factory prices, this store is highly recommended. It has fast shipping guaranteed. Take a look: indian pharmacy online. Hope it helps.

Greetings, Lately came across the best Indian pharmacy to save on Rx. If you want to buy medicines from India at factory prices, this site is the best place. It has wholesale rates guaranteed. Check it out: click here. Cheers.

Hello everyone, I recently found a reliable Mexican pharmacy to save on Rx. If you are tired of high prices and need cheap antibiotics, Pharm Mex is a game changer. Great prices and very reliable. Visit here: https://pharm.mex.com/#. Thank you.

Hey there, To be honest, I found a reliable source for meds for purchasing medications cheaply. For those who need safe pharmacy delivery, this site is very good. They ship globally plus huge selection. Visit here: Online Pharm Store. Be well.

Greetings, Lately found a great resource to buy medication. If you are tired of high prices and need generic drugs, this store is worth checking out. No prescription needed and secure. Take a look: read more. Best wishes.

Greetings, I wanted to share a great international pharmacy for purchasing medications securely. If you need antibiotics, this store is very good. Secure shipping plus no script needed. Check it out: visit website. Regards.

Hey there, I recently discovered an excellent website for purchasing pills cheaply. For those who need antibiotics, this store is worth a look. They ship globally plus it is very affordable. See for yourself: https://onlinepharm.jp.net/#. Best regards.

Hey guys, Just now discovered a useful website for cheap meds. For those looking for cheap antibiotics at factory prices, this site is worth checking. They offer wholesale rates guaranteed. Check it out: India Pharm Store. Best regards.

Hello, Lately stumbled upon the best source from India for affordable pills. For those looking for cheap antibiotics without prescription, this site is very reliable. They offer secure delivery guaranteed. More info here: order medicines from india. Good luck.

Greetings, Lately found an awesome Mexican pharmacy for affordable pills. For those seeking and want cheap antibiotics, this store is a game changer. They ship to USA plus secure. Visit here: check availability. Hope it helps.

Greetings, I wanted to share a reliable source for meds where you can buy prescription drugs securely. If you are looking for no prescription drugs, OnlinePharm is very good. Secure shipping plus it is very affordable. See for yourself: Online Pharm Store. Kind regards.

Hey everyone, I wanted to share a great source for meds for purchasing generics cheaply. If you are looking for safe pharmacy delivery, this store is worth a look. They ship globally and huge selection. Link here: international pharmacy online. Be well.

Hello, I recently discovered a great international pharmacy to order prescription drugs online. If you are looking for safe pharmacy delivery, this site is very good. Great prices plus it is very affordable. Visit here: https://onlinepharm.jp.net/#. Good luck!

Greetings, I just came across a great source from India for cheap meds. If you want to buy generic pills safely, this store is very reliable. You get fast shipping to USA. Check it out: buy meds from india. Cheers.

Hi all, Just now discovered an amazing online drugstore to save on Rx. If you need medicines from India without prescription, IndiaPharm is the best place. It has fast shipping to USA. More info here: India Pharm Store. Good luck.

Hello, To be honest, I found an excellent online drugstore where you can buy medications hassle-free. If you need antibiotics, this store is highly recommended. Secure shipping plus it is very affordable. Check it out: online pharmacy no prescription. I hope you find what you need.

Hey there, I just found a reliable online source for affordable pills. If you are tired of high prices and need affordable prescriptions, Pharm Mex is the best option. They ship to USA plus very reliable. Check it out: https://pharm.mex.com/#. Best wishes.

Hi, I recently discovered an excellent website where you can buy prescription drugs hassle-free. If you are looking for safe pharmacy delivery, this store is highly recommended. They ship globally and it is very affordable. See for yourself: Trust Pharmacy online. Hope it helps.

Greetings, I recently came across the best Indian pharmacy to save on Rx. For those looking for generic pills without prescription, this store is the best place. You get lowest prices guaranteed. More info here: check availability. Cheers.

Hey everyone, I just found a reliable website where you can buy prescription drugs cheaply. For those who need safe pharmacy delivery, this store is the best choice. Great prices plus huge selection. Check it out: https://onlinepharm.jp.net/#. Best regards.

Greetings, I wanted to share a reliable online drugstore where you can buy pills cheaply. If you are looking for cheap meds, this store is the best choice. Secure shipping and it is very affordable. Link here: OnlinePharm. Thank you.

Hello everyone, Lately found a trusted online source for cheap meds. If you want to save money and want affordable prescriptions, this store is the best option. Fast shipping plus very reliable. Link is here: https://pharm.mex.com/#. Best regards.

Greetings, I recently ran into a great website for cheap meds. For those seeking and want generic drugs, Pharm Mex is the best option. They ship to USA and secure. Check it out: https://pharm.mex.com/#. Cheers.

To be honest, I just stumbled upon the best website for affordable pills. If you need ED meds without prescription, this site is very reliable. They offer fast shipping worldwide. Take a look: https://indiapharm.in.net/#. Hope it helps.

Hi, I just found a reliable source for meds to order pills cheaply. If you are looking for no prescription drugs, OnlinePharm is the best choice. Secure shipping plus it is very affordable. Check it out: online pharmacy usa. Best wishes.

Hello, I just found an excellent website to order generics hassle-free. If you need safe pharmacy delivery, OnlinePharm is worth a look. Secure shipping plus it is very affordable. Visit here: https://onlinepharm.jp.net/#. Hope this was useful.

Hi guys, I recently discovered a reliable website for cheap meds. If you want to save money and need affordable prescriptions, Pharm Mex is a game changer. Great prices plus it is safe. Check it out: mexican pharmacy. Thx.

Please let me know if you’re looking for a writer for your site. You have some really good articles and I think I would be a good asset. If you ever want to take some of the load off, I’d love to write some material for your blog in exchange for a link back to mine. Please shoot me an e-mail if interested. Kudos!

To be honest, Just now discovered an awesome online source for affordable pills. If you are tired of high prices and want cheap antibiotics, this site is worth checking out. They ship to USA plus it is safe. Take a look: safe mexican pharmacy. Best regards.

Hey guys, I recently discovered the best Indian pharmacy for affordable pills. If you need generic pills safely, this site is very reliable. You get wholesale rates guaranteed. Take a look: https://indiapharm.in.net/#. Cheers.

Greetings, I recently stumbled upon an amazing Indian pharmacy to buy generics. For those looking for generic pills at factory prices, this site is the best place. You get wholesale rates guaranteed. More info here: India Pharm Store. Best regards.

Hi guys, I just came across an awesome website to save on Rx. If you want to save money and want meds from Mexico, this site is worth checking out. They ship to USA plus it is safe. Check it out: check availability. Best of luck.

Greetings, Just now came across the best online drugstore to save on Rx. If you want to buy cheap antibiotics without prescription, IndiaPharm is worth checking. It has wholesale rates worldwide. More info here: visit website. Cheers.

Hey there, I just discovered a trusted website for cheap meds. If you want to save money and need generic drugs, Pharm Mex is the best option. No prescription needed and very reliable. Visit here: visit website. Best of luck.

code promo melbet du jour telecharger melbet apk

Hey there, I just came across an awesome resource to buy medication. For those seeking and want meds from Mexico, this store is a game changer. They ship to USA and very reliable. Visit here: check availability. Have a great week.

Hello everyone, Just now ran into a reliable online source to save on Rx. If you are tired of high prices and need cheap antibiotics, Pharm Mex is worth checking out. They ship to USA plus very reliable. Check it out: https://pharm.mex.com/#. I hope you find what you need.

application 1win telecharger 1win apk

Hey guys, I recently came across an amazing source from India to buy generics. For those looking for medicines from India cheaply, this store is the best place. You get secure delivery worldwide. Visit here: https://indiapharm.in.net/#. Hope it helps.

Hello everyone, I just ran into an awesome Mexican pharmacy for affordable pills. For those seeking and need affordable prescriptions, Pharm Mex is highly recommended. They ship to USA plus it is safe. Take a look: mexican pharmacy online. Hope it helps.

Greetings, Lately stumbled upon a great Indian pharmacy to save on Rx. If you need cheap antibiotics cheaply, this store is worth checking. They offer wholesale rates to USA. Check it out: https://indiapharm.in.net/#. Cheers.

Greetings, I just ran into a great website to save on Rx. For those seeking and need generic drugs, Pharm Mex is worth checking out. Great prices and secure. Take a look: click here. Have a great week.

Matbet güncel linki lazımsa işte burada. Sorunsuz için tıkla: Matbet Yüksek oranlar bu sitede. Gençler, Matbet son linki açıklandı.

Herkese merhaba, Casibom sitesi üyeleri adına önemli bir paylaşım yapmak istiyorum. Bildiğiniz gibi site giriş linkini BTK engeli yüzünden sürekli güncelledi. Giriş sorunu yaşıyorsanız link aşağıda. Resmi siteye erişim bağlantısı şu an aşağıdadır https://casibom.mex.com/# Paylaştığım bağlantı üzerinden doğrudan hesabınıza bağlanabilirsiniz. Ayrıca yeni üyelere verilen yatırım bonusu kampanyalarını da kaçırmayın. En iyi bahis deneyimi sürdürmek için Casibom tercih edebilirsiniz. Tüm forum üyelerine bol şans dilerim.

Arkadaslar, Grandpashabet son linki belli oldu. Adresi bulamayanlar buradan giris yapabilir https://grandpashabet.in.net/#

Gençler, Grandpashabet Casino son linki açıklandı. Giremeyenler buradan giriş yapabilir Grandpashabet Twitter

Arkadaslar, Grandpashabet yeni adresi belli oldu. Adresi bulamayanlar su linkten devam edebilir Grandpashabet Guncel

Grandpasha giriş linki arıyorsanız işte burada. Hızlı giriş yapmak için Grandpashabet 2026 Deneme bonusu bu sitede.

Arkadaslar selam, Vay Casino kullan?c?lar? icin k?sa bir bilgilendirme yapmak istiyorum. Bildiginiz gibi site adresini tekrar degistirdi. Giris hatas? varsa panik yapmay?n. Guncel Vay Casino giris adresi su an burada: Vaycasino Yeni Adres Paylast?g?m baglant? uzerinden vpn kullanmadan siteye girebilirsiniz. Lisansl? bahis keyfi icin Vaycasino dogru adres. Herkese bol kazanclar dilerim.

Grandpasha guncel adresi laz?msa iste burada. H?zl? giris yapmak icin t?kla https://grandpashabet.in.net/# Yuksek oranlar burada.

Нужен проектор? projector24 большой выбор моделей для дома, офиса и бизнеса. Проекторы для кино, презентаций и обучения, официальная гарантия, консультации специалистов, гарантия качества и удобные условия покупки.

Herkese selam, Vaycasino kullanıcıları için önemli bir duyuru paylaşıyorum. Bildiğiniz gibi site giriş linkini yine değiştirdi. Giriş hatası yaşıyorsanız endişe etmeyin. Yeni Vay Casino giriş adresi şu an aşağıdadır: Resmi Site Bu link üzerinden vpn kullanmadan siteye erişebilirsiniz. Güvenilir bahis deneyimi için Vaycasino tercih edebilirsiniz. Herkese bol kazançlar dilerim.

Arkadaşlar, Grandpashabet yeni adresi belli oldu. Giremeyenler şu linkten giriş yapabilir Grandpashabet İndir

Dostlar selam, Casibom sitesi kullan?c?lar? ad?na onemli bir bilgilendirme yapmak istiyorum. Bildiginiz gibi site giris linkini erisim k?s?tlamas? nedeniyle surekli degistirdi. Erisim sorunu varsa cozum burada. Cal?san siteye erisim baglant?s? su an asag?dad?r https://casibom.mex.com/# Paylast?g?m baglant? ile dogrudan siteye erisebilirsiniz. Ek olarak yeni uyelere sunulan freespin f?rsatlar?n? da kac?rmay?n. Lisansl? slot deneyimi icin Casibom tercih edebilirsiniz. Tum forum uyelerine bol kazanclar dilerim.

Grandpasha giris adresi laz?msa dogru yerdesiniz. H?zl? erisim icin Giris Yap Deneme bonusu bu sitede.

Arkadaşlar, Grandpashabet son linki belli oldu. Adresi bulamayanlar şu linkten giriş yapabilir Grandpashabet Giriş

Grandpasha guncel linki ar?yorsan?z iste burada. Sorunsuz erisim icin t?kla https://grandpashabet.in.net/# Yuksek oranlar bu sitede.

Arkadaşlar, Grandpashabet son linki açıklandı. Adresi bulamayanlar buradan giriş yapabilir https://grandpashabet.in.net/#

Bahis severler selam, Casibom oyuncular? icin onemli bir bilgilendirme paylas?yorum. Bildiginiz gibi site adresini BTK engeli yuzunden yine guncelledi. Giris hatas? varsa cozum burada. Cal?san Casibom giris baglant?s? su an asag?dad?r Giris Yap Paylast?g?m baglant? uzerinden dogrudan hesab?n?za girebilirsiniz. Ayr?ca yeni uyelere sunulan yat?r?m bonusu f?rsatlar?n? mutlaka kac?rmay?n. En iyi slot keyfi surdurmek icin Casibom tercih edebilirsiniz. Herkese bol kazanclar dilerim.

Herkese selam, bu populer site oyuncular? icin onemli bir duyuru yapmak istiyorum. Herkesin bildigi uzere site giris linkini erisim k?s?tlamas? nedeniyle yine tas?d?. Giris problemi varsa cozum burada. Son siteye erisim linki art?k asag?dad?r https://casibom.mex.com/# Bu link uzerinden vpn kullanmadan hesab?n?za baglanabilirsiniz. Ayr?ca yeni uyelere verilen yat?r?m bonusu kampanyalar?n? da kac?rmay?n. En iyi slot deneyimi icin Casibom dogru adres. Herkese bol kazanclar dilerim.

Herkese selam, Casibom sitesi üyeleri adına önemli bir duyuru yapmak istiyorum. Bildiğiniz gibi bahis platformu giriş linkini erişim kısıtlaması nedeniyle yine taşıdı. Erişim problemi varsa çözüm burada. Son Casibom giriş adresi şu an burada https://casibom.mex.com/# Bu link ile vpn kullanmadan hesabınıza bağlanabilirsiniz. Ayrıca kayıt olanlara sunulan hoşgeldin bonusu kampanyalarını da kaçırmayın. Güvenilir casino keyfi sürdürmek için Casibom tercih edebilirsiniz. Tüm forum üyelerine bol şans dilerim.

Arkadaslar, Grandpashabet Casino son linki belli oldu. Giremeyenler su linkten giris yapabilir Grandpashabet Apk

Arkadaşlar selam, Vay Casino kullanıcıları için önemli bir bilgilendirme yapmak istiyorum. Malum platform giriş linkini yine güncelledi. Erişim sorunu yaşıyorsanız endişe etmeyin. Yeni Vaycasino giriş linki şu an burada: Vaycasino Bonus Bu link ile vpn kullanmadan siteye girebilirsiniz. Güvenilir bahis deneyimi sürdürmek için Vaycasino tercih edebilirsiniz. Tüm forum üyelerine bol kazançlar dilerim.

Arkadaslar, Grandpashabet yeni adresi belli oldu. Giremeyenler buradan devam edebilir Grandpashabet 2026

Gencler, Grandpashabet yeni adresi belli oldu. Adresi bulamayanlar su linkten devam edebilir https://grandpashabet.in.net/#

Gençler, Grandpashabet Casino yeni adresi belli oldu. Giremeyenler buradan devam edebilir Grandpashabet Kayıt

Grandpasha giris adresi ar?yorsan?z dogru yerdesiniz. Sorunsuz giris yapmak icin Grandpashabet Twitter Yuksek oranlar bu sitede.

Grandpashabet giriş adresi arıyorsanız işte burada. Hızlı erişim için https://grandpashabet.in.net/# Yüksek oranlar burada.

Herkese selam, Vaycasino oyuncular? ad?na onemli bir bilgilendirme yapmak istiyorum. Malum platform giris linkini tekrar degistirdi. Giris hatas? varsa panik yapmay?n. Yeni Vay Casino giris linki su an burada: Vaycasino Twitter Paylast?g?m baglant? ile direkt hesab?n?za erisebilirsiniz. Guvenilir bahis deneyimi icin Vaycasino dogru adres. Herkese bol sans temenni ederim.

Matbet güncel adresi lazımsa işte burada. Sorunsuz için: Matbet Üyelik Yüksek oranlar bu sitede. Arkadaşlar, Matbet son linki açıklandı.

Arkadaslar selam, Vay Casino oyuncular? ad?na k?sa bir bilgilendirme paylas?yorum. Bildiginiz gibi Vaycasino giris linkini tekrar degistirdi. Erisim hatas? varsa panik yapmay?n. Cal?san Vay Casino giris linki su an burada: Resmi Site Bu link ile vpn kullanmadan hesab?n?za erisebilirsiniz. Guvenilir bahis keyfi icin Vay Casino dogru adres. Herkese bol sans temenni ederim.

ремонт и химчистка обуви химчистка обуви в москве

Dostlar selam, Casibom sitesi kullan?c?lar? ad?na k?sa bir bilgilendirme yapmak istiyorum. Bildiginiz gibi Casibom giris linkini erisim k?s?tlamas? nedeniyle tekrar guncelledi. Erisim sorunu yas?yorsan?z dogru yerdesiniz. Guncel Casibom giris linki art?k asag?dad?r https://casibom.mex.com/# Paylast?g?m baglant? ile direkt hesab?n?za girebilirsiniz. Ayr?ca yeni uyelere sunulan hosgeldin bonusu f?rsatlar?n? mutlaka kac?rmay?n. Guvenilir slot keyfi surdurmek icin Casibom dogru adres. Tum forum uyelerine bol kazanclar dilerim.

Herkese merhaba, Casibom oyuncular? icin k?sa bir paylas?m paylas?yorum. Bildiginiz gibi bahis platformu adresini erisim k?s?tlamas? nedeniyle surekli degistirdi. Giris problemi cekenler icin link asag?da. Cal?san Casibom guncel giris baglant?s? art?k asag?dad?r Casibom Paylast?g?m baglant? uzerinden vpn kullanmadan hesab?n?za girebilirsiniz. Ayr?ca yeni uyelere verilen yat?r?m bonusu kampanyalar?n? da kac?rmay?n. Guvenilir casino deneyimi icin Casibom dogru adres. Tum forum uyelerine bol sans dilerim.

Xin chao 500 anh em, ngu?i anh em nao c?n ch? n?p rut nhanh d? gi?i tri Da Ga thi tham kh?o trang nay nhe. Dang co khuy?n mai: Nha cai BJ88. Hup l?c d?y nha.

недорогой мужской костюм купить мужской костюм

Chao anh em, ai dang tim c?ng game khong b? ch?n d? gi?i tri N? Hu thi xem th? con hang nay. T?c d? ban th?: https://gramodayalawcollege.org.in/#. Chuc cac bac r?c r?.

Hello m?i ngu?i, ngu?i anh em nao c?n trang choi xanh chin d? choi Da Ga thi vao ngay con hang nay. Khong lo l?a d?o: Nha cai Dola789. Chuc cac bac r?c r?.

Chào anh em, nếu anh em đang kiếm sân chơi đẳng cấp để giải trí Casino thì xem thử địa chỉ này. Không lo lừa đảo: sun win. Về bờ thành công.

Xin chao 500 anh em, ngu?i anh em nao c?n ch? n?p rut nhanh d? g? g?c Game bai thi tham kh?o con hang nay. Khong lo l?a d?o: BJ88. V? b? thanh cong.

Hello mọi người, bác nào muốn tìm trang chơi xanh chín để cày cuốc Casino đừng bỏ qua con hàng này. Không lo lừa đảo: https://gramodayalawcollege.org.in/#. Chúc các bác rực rỡ.

Chào cả nhà, bác nào muốn tìm sân chơi đẳng cấp để gỡ gạc Tài Xỉu thì xem thử trang này nhé. Đang có khuyến mãi: Dola789. Chúc các bác rực rỡ.

Лучшее казино https://t.me/ играйте в слоты и live-казино без лишних сложностей. Простой вход, удобный интерфейс, стабильная платформа и широкий выбор игр для отдыха и развлечения.

Играешь в казино? апх Слоты, рулетка, покер и live-дилеры, простой интерфейс, стабильная работа сайта и возможность играть онлайн без сложных настроек.

Chào cả nhà, bác nào muốn tìm cổng game không bị chặn để cày cuốc Nổ Hũ đừng bỏ qua con hàng này. Uy tín luôn: Tải app Dola789. Chúc các bác rực rỡ.

Chao anh em, ai dang tim ch? n?p rut nhanh d? cay cu?c N? Hu thi vao ngay trang nay nhe. Khong lo l?a d?o: Link khong b? ch?n. V? b? thanh cong.

Лучшее казино ап икс официальный играйте в слоты и live-казино без лишних сложностей. Простой вход, удобный интерфейс, стабильная платформа и широкий выбор игр для отдыха и развлечения.

Iver Protocols Guide: Iver Protocols Guide – Iver Protocols Guide

Amitriptyline Elavil Generic Elavil

Follicle Insight: generic propecia without prescription – Follicle Insight

AmiTrip Relief Store: AmiTrip Relief Store – AmiTrip

stromectol 3 mg dosage stromectol 3 mg dosage Iver Protocols Guide

https://follicle.us.com/# Follicle Insight

https://fertilitypctguide.us.com/# can i get clomid without prescription

can i get clomid no prescription: fertility pct guide – where can i buy clomid without a prescription

generic propecia price: Follicle Insight – buy propecia without dr prescription

https://amitrip.us.com/# Generic Elavil

Hi , I do believe this is an excellent blog. I stumbled upon it on Yahoo , i will come back once again. Money and freedom is the best way to change, may you be rich and help other people.

buying propecia online: get generic propecia pills – cheap propecia without insurance

https://amitrip.us.com/# AmiTrip

Iver Protocols Guide: can you buy stromectol over the counter – Iver Protocols Guide

https://fertilitypctguide.us.com/# can i get clomid prices

fertility pct guide fertility pct guide fertility pct guide

Elavil: Generic Elavil – AmiTrip Relief Store

Iver Protocols Guide: ivermectin cost – Iver Protocols Guide

https://fertilitypctguide.us.com/# fertility pct guide

https://follicle.us.com/# cost cheap propecia tablets

where can i get cheap clomid pills: cost of clomid without a prescription – where buy cheap clomid without prescription

Iver Protocols Guide: ivermectin 500mg – ivermectin 500ml

https://fertilitypctguide.us.com/# how to buy cheap clomid online

Elavil buy Elavil Elavil

cheap propecia pills: Follicle Insight – buying generic propecia tablets

https://amitrip.us.com/# Elavil

where to buy clomid online: fertility pct guide – can i buy cheap clomid

https://fertilitypctguide.us.com/# buying generic clomid without dr prescription

where buy cheap clomid without prescription: how to buy clomid without rx – fertility pct guide

fertility pct guide: fertility pct guide – can i buy clomid prices

https://fertilitypctguide.us.com/# cost of cheap clomid tablets

https://iver.us.com/# Iver Protocols Guide

ivermectin nz: ivermectin lotion cost – ivermectin cream

Elavil Generic Elavil Amitriptyline

cost cheap propecia without a prescription: order cheap propecia without a prescription – Follicle Insight

https://iver.us.com/# Iver Protocols Guide

how cЙ‘n i get cheap propecia pills: Follicle Insight – generic propecia

https://fertilitypctguide.us.com/# fertility pct guide

https://fertilitypctguide.us.com/# fertility pct guide

cost cheap propecia without prescription: Follicle Insight – Follicle Insight

AmiTrip: AmiTrip – Generic Elavil

https://iver.us.com/# ivermectin where to buy

cost cheap propecia price Follicle Insight Follicle Insight

fertility pct guide: fertility pct guide – fertility pct guide

https://follicle.us.com/# Follicle Insight

buy ivermectin cream: Iver Protocols Guide – ivermectin 1 cream 45gm

https://fertilitypctguide.us.com/# can i order generic clomid pill

ivermectin buy australia: Iver Protocols Guide – ivermectin nz

Hello, I recently found dosage instructions regarding prescription drugs, I recommend this drug database. You can read about drug interactions in detail. Read more here: https://magmaxhealth.com/Toradol. Very informative.

Greetings, for those searching for dosage instructions regarding common medicines, I found this useful resource. It explains usage and risks clearly. See details: https://magmaxhealth.com/Clomid. Thanks.

Hello, anyone searching for a trusted online pharmacy to buy prescription drugs online. Check out this pharmacy: lamictal. Selling generic tablets with fast shipping. Hope this helps.

regarding the proper usage instructions, it is recommended to check the official information page at: https://magmaxhealth.com/naltrexone.html which covers safe treatment.

Greetings, if you are looking for dosage instructions regarding health treatments, check out this medical reference. You can read about drug interactions in detail. Link: https://magmaxhealth.com/Rosuvastatin. Very informative.

To start saving, I recommend this reliable site here for the best prices. Get your meds today and save big.

Hey everyone, I recently found a useful article regarding health treatments, I recommend this useful resource. It explains usage and risks in detail. Reference: https://magmaxhealth.com/Naltrexone. Thanks.

Hello, if you need a trusted drugstore to buy medicines online. Check out this site: clomid. Stocking generic tablets and huge discounts. Hope this helps.

To start saving, visit this service pharmacy online usa to order now. Take control of your health and save big.

Hi, if anyone needs dosage instructions on health treatments, take a look at this drug database. You can read about drug interactions in detail. Source: https://magmaxhealth.com/Toradol. Hope this is useful.

To understand the medical specifications, you can consult this resource: https://magmaxhealth.com/rosuvastatin.html for correct administration.

Hey everyone, I wanted to share a great health store to order pills online. I recommend this site: olanzapine. Selling a wide range of meds at the best prices. Best regards.

In terms of side effects and interactions, data is available at the medical directory at: https://magmaxhealth.com/prilosec.html which covers safe treatment.

Greetings, if anyone needs a useful article on common medicines, take a look at this useful resource. You can read about usage and risks very well. Reference: https://magmaxhealth.com/Allopurinol. Good info.

Hi all, for those searching for a useful article about prescription drugs, take a look at this medical reference. You can read about usage and risks very well. Source: https://magmaxhealth.com/Toradol. Thanks.

Hello, if you need a great drugstore to buy medicines online. Check out this pharmacy: toradol. Selling a wide range of meds and huge discounts. Good luck.

For a complete overview of medical specifications, please review this resource: https://magmaxhealth.com/methotrexate.html which covers safe treatment.

Hi all, for those searching for side effects info regarding various medications, take a look at this drug database. It explains how to take meds clearly. Read more here: https://magmaxhealth.com/Allopurinol. Thanks.

Hey everyone, if anyone needs side effects info about various medications, take a look at this useful resource. It covers usage and risks clearly. Link: https://magmaxhealth.com/Methotrexate. Good info.

Hi all, if anyone needs a medical guide on common medicines, I found this useful resource. You can read about how to take meds in detail. Reference: https://magmaxhealth.com/Prilosec. Good info.

regarding the medical specifications, you can consult this resource: https://magmaxhealth.com/lipitor.html for clinical details.

Hello, if you are looking for an affordable health store to purchase pills online. Take a look at MagMaxHealth: toradol. Stocking generic tablets and huge discounts. Good luck.

Nausea Care US: Nausea Care US – Nausea Care US

Gastro Health Monitor: omeprazole brand name – omeprazole generic

https://gastrohealthmonitor.com/# Gastro Health Monitor

Nausea Care US: Nausea Care US – ondansetron

generic for zofran: buy zofran – ondansetron otc

buy zofran online: Nausea Care US – Nausea Care US

http://spasmreliefprotocols.com/# methocarbamol robaxin

generic for zofran: Nausea Care US – Nausea Care US

ondansetron zofran: zofran dosage – Nausea Care US

Nausea Care US Nausea Care US zofran otc

muscle relaxant drugs: Spasm Relief Protocols – muscle relaxers over the counter

tizanidine hcl: robaxin – tizanidine muscle relaxer

https://gastrohealthmonitor.shop/# omeprazole generic

Gastro Health Monitor: omeprazole generic – Gastro Health Monitor

Gastro Health Monitor: Gastro Health Monitor – Gastro Health Monitor

muscle relaxant drugs: Spasm Relief Protocols – п»їbest muscle relaxer

robaxin: over the counter muscle relaxers that work – muscle relaxer tizanidine

prilosec medication: prilosec dosage – omeprazole brand name

https://nauseacareus.com/# ondansetron medication

Gastro Health Monitor: prilosec dosage – prilosec dosage

buy zofran: Nausea Care US – Nausea Care US

п»їbest muscle relaxer: Spasm Relief Protocols – zanaflex medication

best muscle relaxer: Spasm Relief Protocols – buy tizanidine without prescription

https://nauseacareus.shop/# Nausea Care US

Nausea Care US: Nausea Care US – Nausea Care US

muscle relaxant drugs: buy methocarbamol – buy tizanidine without prescription

Gastro Health Monitor: omeprazole prilosec – Gastro Health Monitor

buy zofran: Nausea Care US – generic for zofran

https://gastrohealthmonitor.shop/# Gastro Health Monitor

Gastro Health Monitor: Gastro Health Monitor – Gastro Health Monitor

Gastro Health Monitor: buy prilosec online – generic prilosec

tizanidine hydrochloride: Spasm Relief Protocols – buy methocarbamol without prescription

https://spasmreliefprotocols.shop/# buy methocarbamol

omeprazole over the counter: prilosec medication – prilosec dosage

muscle relaxers over the counter: tizanidine zanaflex – tizanidine hcl

over the counter muscle relaxers that work: Spasm Relief Protocols – tizanidine generic

Gastro Health Monitor: prilosec generic – Gastro Health Monitor

https://nauseacareus.shop/# ondestranon zofran

robaxin medication: buy tizanidine without prescription – muscle relaxer medication

muscle relaxers over the counter: Spasm Relief Protocols – buy methocarbamol without prescription

https://gastrohealthmonitor.com/# omeprazole over the counter

prilosec side effects: Gastro Health Monitor – prilosec generic

https://gastrohealthmonitor.shop/# omeprazole medication

otc muscle relaxer: Spasm Relief Protocols – antispasmodic medication

http://gastrohealthmonitor.com/# buy prilosec

Nausea Care US: Nausea Care US – zofran over the counter

https://gastrohealthmonitor.shop/# Gastro Health Monitor

http://spasmreliefprotocols.com/# robaxin medication

https://spasmreliefprotocols.shop/# robaxin

robaxin generic: buy tizanidine without prescription – tizanidine hydrochloride

https://nauseacareus.com/# Nausea Care US

top online pharmacy india: online shopping pharmacy india – best online pharmacy india

https://indogenericexport.com/# best india pharmacy

https://indogenericexport.com/# buy methocarbamol without prescription

tizanidine muscle relaxer: Spasm Relief Protocols – otc muscle relaxer

US Meds Outlet: pharmacy online 365 discount code – US Meds Outlet

https://usmedsoutlet.shop/# US Meds Outlet

https://indogenericexport.com/# online shopping pharmacy india

US Meds Outlet: US Meds Outlet – US Meds Outlet

https://indogenericexport.com/# over the counter muscle relaxers that work

https://usmedsoutlet.com/# online pharmacy india

https://bajameddirect.shop/# pharma mexicana

BajaMed Direct: BajaMed Direct – purple pharmacy mexico

https://indogenericexport.shop/# antispasmodic medication

mexican pharmacy menu: BajaMed Direct – mexican pharma

http://indogenericexport.com/# muscle relaxer tizanidine

http://indogenericexport.com/# methocarbamol robaxin

US Meds Outlet: online pharmacy group – canadian pharmacy ltd

humana online pharmacy: US Meds Outlet – escrow pharmacy canada

https://indogenericexport.com/# robaxin medication

medication in mexico: BajaMed Direct – online mexican pharmacy

http://usmedsoutlet.com/# US Meds Outlet

online pharmacy india: п»їlegitimate online pharmacies india – top 10 pharmacies in india

pharmacy website india: Indo-Generic Export – legitimate online pharmacies india

https://indogenericexport.shop/# buy methocarbamol

BajaMed Direct: BajaMed Direct – BajaMed Direct

mexico farmacia: mexico prescriptions – BajaMed Direct

US Meds Outlet: US Meds Outlet – US Meds Outlet

indian pharmacy paypal: top online pharmacy india – best india pharmacy

safe canadian pharmacy: canadian discount pharmacy – US Meds Outlet

mail order pharmacy india: indian pharmacy online – buy prescription drugs from india

reputable indian online pharmacy: world pharmacy india – indianpharmacy com

costco online pharmacy: walgreens online pharmacy – US Meds Outlet

https://usmedsoutlet.com/# no prescription pharmacy paypal

BajaMed Direct: BajaMed Direct – online pharmacies

https://bajameddirect.com/# BajaMed Direct

BajaMed Direct: BajaMed Direct – BajaMed Direct

BajaMed Direct: online pharmacies – farmacia pharmacy mexico

https://indogenericexport.com/# top 10 pharmacies in india

india pharmacy mail order: Indo-Generic Export – india pharmacy

https://bajameddirect.com/# mexican pharmacy

canadian pharmacy 365: pharmacy no prescription required – US Meds Outlet

india pharmacy mail order: Indo-Generic Export – top 10 online pharmacy in india

https://indogenericexport.com/# mail order pharmacy india

online pharmacy india: online pharmacy india – pharmacy website india

Essayez le meilleur nouveau casino en ligne France Bonus de

bienvenue large choix de jeux depots securises et retraits rapides Inscrivez vous des maintenant

I dugg some of you post as I cogitated they were very helpful extremely helpful

uk pharmacy no prescription: US Meds Outlet – US Meds Outlet

http://bajameddirect.com/# phentermine in mexico pharmacy

BajaMed Direct: BajaMed Direct – BajaMed Direct

https://bajameddirect.shop/# BajaMed Direct

online shopping pharmacy india: Indo-Generic Export – world pharmacy india

cheapest online pharmacy india: indian pharmacies safe – top online pharmacy india

https://indogenericexport.shop/# indianpharmacy com

canadian pharmacy generic cialis: canadian online pharmacy viagra – US Meds Outlet

http://ivertherapeutics.com/# Iver Therapeutics

Neuro Relief USA: Neuro Relief USA – generic neurontin pill

http://neuroreliefusa.com/# Neuro Relief USA

order zoloft: zoloft without dr prescription – generic for zoloft

https://ivertherapeutics.shop/# stromectol tablets buy online

sertraline generic: zoloft without dr prescription – zoloft tablet

https://neuroreliefusa.shop/# neurontin 500 mg

stromectol ireland: ivermectin new zealand – ivermectin cost canada

http://smartgenrxusa.com/# good pill pharmacy

Smart GenRx USA: Smart GenRx USA – Smart GenRx USA

http://ivertherapeutics.com/# cost of ivermectin 1% cream

Smart GenRx USA: canadian pharmacy phone number – canadian pharmacy no scripts

http://smartgenrxusa.com/# Smart GenRx USA

http://smartgenrxusa.com/# online pharmacy indonesia

online pharmacy 365: online pharmacy europe – all med pharmacy

Neuro Relief USA Neuro Relief USA Neuro Relief USA

http://sertralineusa.com/# zoloft buy

Neuro Relief USA: neurontin prescription medication – neurontin 300 mg price in india

Neuro Relief USA: Neuro Relief USA – gabapentin generic

https://neuroreliefusa.com/# Neuro Relief USA

ivermectin 6mg dosage: ivermectin stromectol – Iver Therapeutics

https://ivertherapeutics.shop/# stromectol ireland

Smart GenRx USA Smart GenRx USA Smart GenRx USA

generic for zoloft: sertraline zoloft – zoloft without dr prescription

https://smartgenrxusa.com/# reliable canadian pharmacy reviews

Iver Therapeutics: Iver Therapeutics – Iver Therapeutics

http://sertralineusa.com/# sertraline zoloft

Neuro Relief USA neurontin 500 mg tablet Neuro Relief USA

ivermectin 400 mg brands: ivermectin 2mg – ivermectin uk

https://neuroreliefusa.shop/# neurontin singapore

stromectol tab price: ivermectin 250ml – Iver Therapeutics

http://neuroreliefusa.com/# Neuro Relief USA

order zoloft: order zoloft – zoloft without dr prescription

zoloft without dr prescription order zoloft zoloft generic

http://ivertherapeutics.com/# ivermectin usa

neurontin 200 mg capsules: gabapentin generic – neurontin medication

Ontvang de beste casino bonussen van 2025!

Speel in legale Nederlandse online casinos, profiteer van free

spins en stortingsbonussen en maak kans op echte geldprijzen. Veilig, snel en eerlijk gokken voor elke speler.

Smart GenRx USA: canadianpharmacyworld – Smart GenRx USA

https://sertralineusa.com/# zoloft tablet

ivermectin 400 mg brands Iver Therapeutics ivermectin for sale

zoloft pill: zoloft pill – sertraline zoloft

http://sertralineusa.com/# sertraline zoloft

Neuro Relief USA: can i buy neurontin over the counter – neurontin 600 mg coupon

https://neuroreliefusa.com/# canada neurontin 100mg lowest price

generic zoloft: generic zoloft – zoloft without rx

pharmacy express Smart GenRx USA Smart GenRx USA

https://neuroreliefusa.com/# neurontin 4 mg

zoloft cheap: zoloft cheap – buy zoloft

https://sertralineusa.com/# zoloft generic

top 10 pharmacy websites: Smart GenRx USA – Smart GenRx USA

http://ivertherapeutics.com/# Iver Therapeutics

Neuro Relief USA Neuro Relief USA Neuro Relief USA

best online foreign pharmacies: top online pharmacy 247 – canadien pharmacies

https://ivertherapeutics.shop/# Iver Therapeutics

Smart GenRx USA: northern pharmacy canada – Smart GenRx USA

Ce guide est destine aux joueurs qui recherchent une evaluation structuree du

casino en ligne MyStake un site multifonctionnel qui propose un casino des mini jeux des

paris et differents bonus

https://smartgenrxusa.com/# Smart GenRx USA

canadian pharmacy online ship to usa: Smart GenRx USA – Smart GenRx USA

sertraline Sertraline USA zoloft generic

buy zoloft: sertraline zoloft – generic zoloft

zoloft without dr prescription: generic zoloft – sertraline zoloft

https://smartgenrxusa.shop/# pharmacy shop

Iver Therapeutics: stromectol drug – stromectol oral

zoloft generic Sertraline USA generic zoloft

Iver Therapeutics: Iver Therapeutics – Iver Therapeutics

how much is generic neurontin: neurontin drug – Neuro Relief USA

https://sertralineusa.com/# zoloft tablet

https://sertralineusa.com/# buy zoloft

canadian pharmacy levitra: pharmaceuticals online australia – Smart GenRx USA

canadian pharmacy world canadian valley pharmacy Smart GenRx USA

Smart GenRx USA: canadian pharmacy king reviews – Smart GenRx USA

https://ivertherapeutics.shop/# Iver Therapeutics

sertraline: generic zoloft – zoloft no prescription

https://sertralineusa.com/# zoloft without dr prescription

http://neuroreliefusa.com/# generic neurontin 300 mg

Neuro Relief USA: buy gabapentin – neurontin 400 mg capsule

https://ivertherapeutics.com/# ivermectin

ivermectin over the counter ivermectin 3 mg tablet dosage Iver Therapeutics

buy zoloft: buy zoloft – sertraline zoloft

https://smartgenrxusa.com/# Smart GenRx USA

canadian pharmacy no prescription: Smart GenRx USA – pharmacy online 365

https://sertralineusa.com/# generic for zoloft

https://ivertherapeutics.com/# Iver Therapeutics

Iver Therapeutics: Iver Therapeutics – buy ivermectin cream

https://sertralineusa.com/# zoloft without dr prescription

Iver Therapeutics ivermectin lotion for lice Iver Therapeutics

zoloft without rx: zoloft tablet – zoloft cheap

http://neuroreliefusa.com/# Neuro Relief USA

ivermectin 12 mg: Iver Therapeutics – ivermectin price comparison

http://smartgenrxusa.com/# rx pharmacy

https://smartgenrxusa.shop/# pharmacy online australia free shipping

neurontin 4 mg: neurontin 100 mg cost – Neuro Relief USA

neurontin discount: Neuro Relief USA – buy neurontin 300 mg

https://ivertherapeutics.com/# ivermectin 6 mg tablets

buy zoloft zoloft medication zoloft buy

Neuro Relief USA: Neuro Relief USA – neurontin 600 mg price

https://neuroreliefusa.shop/# Neuro Relief USA

can i buy neurontin over the counter: Neuro Relief USA – Neuro Relief USA

Smart GenRx USA: Smart GenRx USA – online pharmacy europe

https://smartgenrxusa.com/# canadian pharmacy without prescription

order zoloft: buy zoloft – zoloft no prescription

neurontin 500 mg: Neuro Relief USA – Neuro Relief USA

Neuro Relief USA gabapentin 600 mg Neuro Relief USA

https://sertralineusa.shop/# generic zoloft

https://smartgenrxusa.shop/# online pharmacy prescription

Smart GenRx USA: Smart GenRx USA – Smart GenRx USA

Iver Therapeutics: Iver Therapeutics – stromectol 3 mg

https://smartgenrxusa.com/# no rx pharmacy

Smart GenRx USA: Smart GenRx USA – Smart GenRx USA

Iver Therapeutics Iver Therapeutics Iver Therapeutics

Neuro Relief USA: Neuro Relief USA – medication neurontin 300 mg

http://neuroreliefusa.com/# neurontin 200 mg tablets

ivermectin for sale: Iver Therapeutics – Iver Therapeutics

https://smartgenrxusa.com/# Smart GenRx USA

generic zoloft: Sertraline USA – zoloft cheap

Neuro Relief USA: Neuro Relief USA – neurontin 300mg tablet cost

Neuro Relief USA: Neuro Relief USA – Neuro Relief USA

Iver Therapeutics Iver Therapeutics stromectol ivermectin buy

https://ivertherapeutics.shop/# Iver Therapeutics

neurontin 800 mg cost: neurontin 300 mg cost – neurontin 500 mg

Iver Therapeutics: Iver Therapeutics – ivermectin 6mg

Iver Therapeutics: Iver Therapeutics – ivermectin 3mg tablets

stromectol tablets uk: stromectol covid – Iver Therapeutics

zoloft without rx sertraline zoloft buy zoloft

http://sertralineusa.com/# sertraline

stromectol medicine: Iver Therapeutics – ivermectin 6mg dosage

Neuro Relief USA: neurontin 800 mg cost – Neuro Relief USA

ремонт дизайн интерьера студия дизайна интерьера спб

https://ivertherapeutics.com/# Iver Therapeutics

https://ivertherapeutics.shop/# stromectol cost

Iver Therapeutics: ivermectin oral solution – ivermectin lice

neurontin prescription: neurontin from canada – neurontin brand name 800 mg

http://sertralineusa.com/# generic for zoloft

canadian pharmacy no prescription needed: canadian 24 hour pharmacy – Smart GenRx USA

zoloft generic sertraline zoloft zoloft no prescription

https://neuroreliefusa.com/# Neuro Relief USA

zoloft no prescription: zoloft no prescription – zoloft medication

Neuro Relief USA: neurontin 100 mg cost – neurontin rx

https://neuroreliefusa.com/# neurontin 204

Smart GenRx USA: 24 hours pharmacy – Smart GenRx USA

http://ivertherapeutics.com/# buy ivermectin pills

Neuro Relief USA: Neuro Relief USA – neurontin 900 mg

ivermectin 3mg tablets Iver Therapeutics stromectol how much it cost

professional pharmacy: Smart GenRx USA – Smart GenRx USA

https://ivertherapeutics.shop/# ivermectin usa

https://sertralineusa.shop/# zoloft no prescription

canada pharmacy world: Smart GenRx USA – Smart GenRx USA

stromectol 12mg: ivermectin stromectol – Iver Therapeutics

https://ivertherapeutics.com/# ivermectin 3mg tablets

Smart GenRx USA: Smart GenRx USA – tops pharmacy

http://ivertherapeutics.com/# Iver Therapeutics

Iver Therapeutics: Iver Therapeutics – Iver Therapeutics

ivermectin 5 mg ivermectin canada Iver Therapeutics

https://sertralineusa.shop/# order zoloft

http://sertralineusa.com/# zoloft tablet

Iver Therapeutics: Iver Therapeutics – Iver Therapeutics

http://smartgenrxusa.com/# canadapharmacyonline

Iver Therapeutics: Iver Therapeutics – Iver Therapeutics

Smart GenRx USA: Smart GenRx USA – buying from canadian pharmacies

http://ivertherapeutics.com/# ivermectin over the counter canada

gold pharmacy online Smart GenRx USA Smart GenRx USA

Smart GenRx USA: Smart GenRx USA – cialis canadian pharmacy

https://smartgenrxusa.com/# Smart GenRx USA

http://sertralineusa.com/# sertraline

Iver Therapeutics: Iver Therapeutics – stromectol 3mg cost

stromectol cost: Iver Therapeutics – stromectol generic name

https://smartgenrxusa.shop/# Smart GenRx USA

online pharmacy weight loss: Smart GenRx USA – canadian discount pharmacy

https://ivertherapeutics.shop/# ivermectin drug

legal online pharmacy coupon code: Smart GenRx USA – Smart GenRx USA

https://smartgenrxusa.com/# Smart GenRx USA

neurontin 50mg cost Neuro Relief USA prescription price for neurontin

Охраны труда для бизнеса охрана труда аудит системы безопасности, обучение персонала, разработка локальных актов и внедрение стандартов. Помогаем минимизировать риски и избежать штрафов.

Проблемы с зубами? стоматологический центр профилактика, лечение, протезирование и эстетическая стоматология. Забота о здоровье зубов с применением передовых методик.

A professional house renovation company Moraira can transform an outdated property into a modern luxury villa. As a leading renovation company Moraira, we bring expert craftsmanship to modernize your kitchen or living areas, significantly increasing your home’s market value.

neurontin 50mg cost: Neuro Relief USA – Neuro Relief USA

A professional house renovation company Moraira can transform an outdated property into a modern luxury villa. As a leading renovation company Moraira, we bring expert craftsmanship to modernize your kitchen or living areas, significantly increasing your home’s market value.

Охраны труда для бизнеса охрана труда дистанционно аудит системы безопасности, обучение персонала, разработка локальных актов и внедрение стандартов. Помогаем минимизировать риски и избежать штрафов.

https://sertralineusa.com/# Sertraline USA

Нужен фулфилмент? фулфилмент для маркетплейсов — хранение, сборка заказов, возвраты и учет остатков. Работаем по стандартам площадок и соблюдаем сроки поставок.

Neuro Relief USA: Neuro Relief USA – Neuro Relief USA

Запчасти для сельхозтехники https://selkhozdom.ru и спецтехники МТЗ, МАЗ, Амкодор — оригинальные и аналоговые детали в наличии. Двигатели, трансмиссия, гидравлика, ходовая часть с быстрой доставкой и гарантией качества.

Оформления медицинских справок https://med-official2.info справки для трудоустройства, водительские, в бассейн и учебные заведения. Купить справку онлайн быстро

Медицинская справка https://086y-spr.info 086у в Москве по доступной цене — официальное оформление для поступления в вуз или колледж.

neurontin 200: Neuro Relief USA – buying neurontin online

Медицинские справки https://norma-spravok2.info по доступной цене — официальное оформление. Быстрая запись, прозрачная стоимость и выдача документа установленного образца.

Оформление медицинских https://spr-goroda2.info справок в Москве недорого консультации специалистов и выдача официальных документов. Соблюдение стандартов и минимальные сроки получения.

https://smartgenrxusa.com/# Smart GenRx USA

Медицинские справки https://medit-norma1.info в Москве с прозрачной ценой — анализы и выдача официального документа без лишних ожиданий. Удобная запись, прозрачные цены и быстрое получение документа установленного образца.

Медицинская справка https://sp-dom1.ru с доставкой — официальное оформление. Удобная запись, прозрачные цены и получение документа курьером.

Получение медицинской https://gira-spravki2.ru справки с доставкой после официального оформления. Комфортная запись, минимальные сроки и законная выдача документа.

Справка 29н https://forma-029.ru в Москве с доставкой — без прохождение обязательного медосмотра в клинике. Отправка готового документа по указанному адресу.