A New Regulatory Environment

In January 2023, Spain introduced its Plastic Packaging Tax, a move designed to reduce plastic waste and encourage more sustainable packaging practices. This tax, which imposes a charge of €0.45 per kilogram on non-recycled, non-reusable plastic affects a wide range of industries including the fresh produce sector. This makes the need for sustainable, cost-effective packaging solutions more pressing than ever.

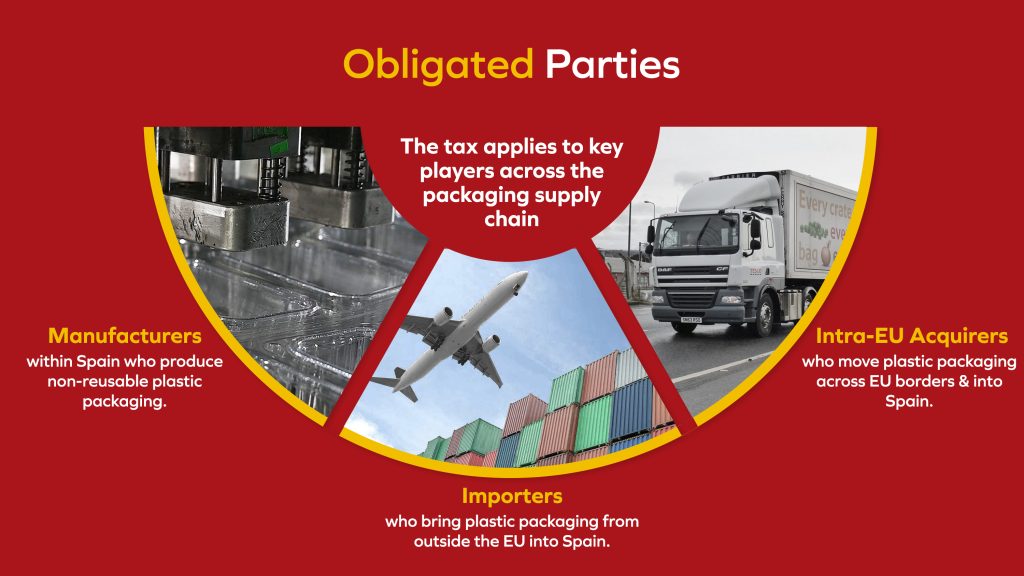

Obligated Parties and Compliance Challenges

The tax applies to key players across the packaging supply chain:

- Manufacturers within Spain who produce non-reusable plastic packaging.

- Importers who bring plastic packaging from outside the EU into Spain.

- Intra-EU Acquirers who move plastic packaging across EU borders and into Spain.

Each of these entities must navigate complex compliance requirements, including registration with the Plastic Tax territorial registry and the submission of regular tax returns. Non-compliance can result in significant financial penalties.

Regulatory Exemptions and Opportunities

While the tax is comprehensive, several exemptions exist, including reusable packaging and certain medical-related packaging. Companies handling small quantities of non-recycled plastic may also be exempt. However, these exemptions come with stringent documentation requirements, and incorrect application can lead to substantial penalties, including fines up to 150% of the incorrectly claimed tax benefit, with a minimum amount of 1,000 Euros. (European Tax Blog) (PBS) (BOE)

Given the strict regulatory environment and potential penalties, it’s crucial for businesses to reduce the amount of non-recycled content contained in their packaging and work with credible suppliers who can provide certified, compliant recycled packaging solutions.

Lowering Tax Liabilities With Certified Recycled Content

The Spanish Plastic Packaging Tax can be reduced if your packaging contains certified recycled content. Initially, self-declarations were accepted, but as of January 2024, third-party certification is mandatory. RecyClass offers audit schemes that companies can use to qualify for this tax exemption.

RecyClass provides two certification options: the Recycling Process Certification, which verifies the source of waste used in producing recycled materials, and the Recycled Plastics Traceability Certification, which tracks recycled plastics throughout the production chain. These certifications comply with EN 15343 standards and are accredited under ISO 17065, meeting legal requirements for tax deductions on recycled content.

These certifications ensure that the recycled material in your packaging is properly validated, allowing businesses to effectively reduce their tax liabilities under the new regulations.

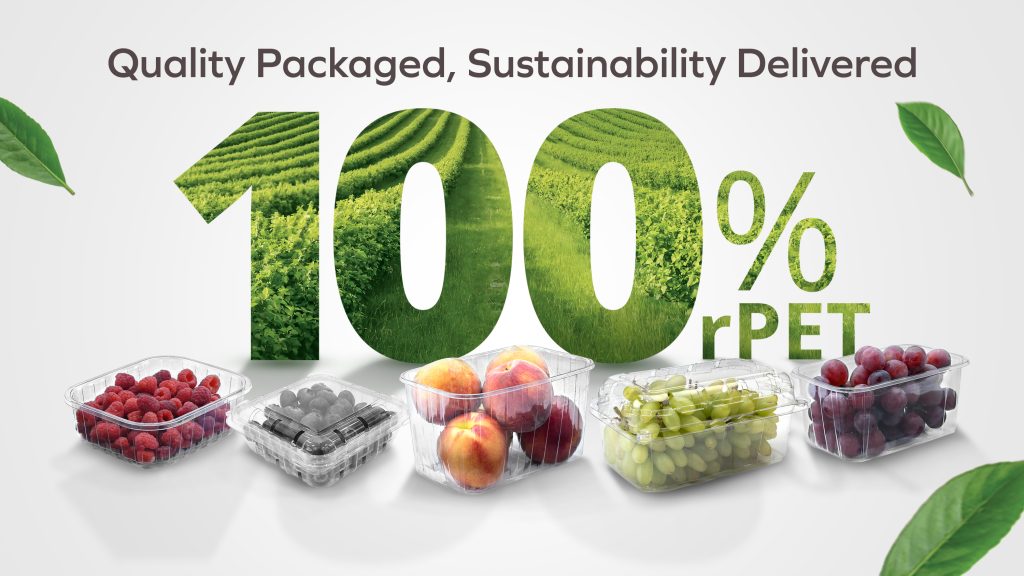

The Strategic Role of 100% rPET: Meeting Compliance and Sustainability Goals

To stay ahead of challenges presented by the Spanish Plastic Packaging Tax, companies particularly in the fresh produce sector are turning to 100% recycled PET (rPET). Recycled content is not only exempt from the tax but also aligns with growing consumer demand for sustainable products. For the fresh produce industry, where packaging must be both durable and transparent, rPET offers a practical and environmentally responsible option. Further, PET stands out as a input material due to its high recycling rates, which ensure a consistent supply of recycled flakes.

Choosing 100% rPET is more than a compliance strategy—it’s a proactive approach to sustainability that also supports Extended Producer Responsibility (EPR) regulations which require producers to manage the full lifecycle of their packaging, from production through to recycling.

AVI Global Plast: A Credible Packaging Partner for Compliance

AVI Global Plast, a leading and trusted Indian packaging manufacturer with a presence in over 30 countries, including Spain, offers cost-effective 100% rPET punnets and trays that comply with the Spanish Plastic Packaging Tax.

AVI’s focus is on helping growers, distributors, and retailers of plastic packaging source market-tested solutions at significant cost savings. Leveraging India’s robust PET recycling infrastructure and PCR flake availability, the company provides recycled packaging at a fraction of the cost of punnets in Europe.

AVI’s offerings are certified by global standards like InterTek and ISCC Plus, ensuring sustainability and quality. The company has also applied to certify its 100% PCR punnets under standard UNE EN 15343 for third-party verification, traceability and meeting legal requirements for Spanish tax exemptions on recycled content.

The Path Forward

As the fresh produce industry adapts to the new realities imposed by the Spanish Plastic Packaging Tax, it’s clear that compliance and sustainability are no longer optional—they’re essential. The adoption of 100% rPET packaging offers a viable path forward, enabling businesses to meet regulatory requirements while also supporting broader environmental goals. For companies of all sizes, from large multinationals to small and medium-sized enterprises, choosing credible suppliers like AVI Global Plast can provide the tools and expertise needed to turn regulatory challenges into opportunities for growth and innovation.

To access full details on the Spanish Plastic Packaging Tax, please refer to the official legislation at: https://www.boe.es/buscar/act.php?id=BOE-A-2022-5809

For enquires, you can email manasvi@avigloplast.com or call +91 022-68559300

ghxip8

Some genuinely nice and utilitarian information on this site, too I believe the style and design has excellent features.

Greetings! Very helpful advice on this article! It is the little changes that make the biggest changes. Thanks a lot for sharing!

Hmm is anyone else encountering problems with the pictures on this blog loading? I’m trying to determine if its a problem on my end or if it’s the blog. Any feedback would be greatly appreciated.

Thank you for the sensible critique. Me & my neighbor were just preparing to do some research on this. We got a grab a book from our local library but I think I learned more clear from this post. I’m very glad to see such excellent info being shared freely out there.

Recently, I was looking for Amoxicillin fast and found a great source. They let you order meds no script legally. In case of strep throat, try here. Express delivery available. Check it out: visit website. Cheers.

Actually, I was looking for antibiotics urgently and discovered this amazing site. You can get treatment fast legally. If you have sinusitis, I recommend this site. Express delivery available. Go here: Antibiotics Express pharmacy. Highly recommended.

Just now, I was looking for Amoxicillin for a toothache and discovered Amoxicillin Express. They sell effective treatment cheaply. If you need meds, highly recommended: generic amoxil online. Hope it helps.

Just now, I was looking for scabies treatment medication and found Ivermectin Express. They sell 3mg, 6mg & 12mg tablets with express shipping. For treating infections effectively, visit this link: ivermectinexpress.com. Fast delivery

Situs Bonaslot adalah bandar judi slot online nomor 1 di Indonesia. Ribuan member sudah mendapatkan Maxwin sensasional disini. Transaksi super cepat hanya hitungan menit. Situs resmi login sekarang gas sekarang bosku.

Online slot oynamak isteyenler için kılavuz niteliğinde bir site: siteyi incele Nerede oynanır diye düşünmeyin. Editörlerimizin seçtiği casino siteleri listesi ile rahatça oynayın. Detaylar linkte.

Info slot gacor malam ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Situs ini gampang menang dan aman. Promo menarik menanti anda. Kunjungi: п»їhttps://bonaslotind.us.com/# Bonaslot link alternatif dan menangkan.

п»їSalam Gacor, cari situs slot yang mudah menang? Rekomendasi kami adalah Bonaslot. RTP Live tertinggi hari ini dan pasti bayar. Isi saldo bisa pakai Dana tanpa potongan. Login disini: п»їBonaslot salam jackpot.

Merhaba arkadaşlar, sağlam casino siteleri arıyorsanız, hazırladığımız listeye mutlaka göz atın. Lisanslı firmaları ve fırsatları sizin için listeledik. Dolandırılmamak için doğru adres: casino siteleri 2026 iyi kazançlar.

Pin-Up AZ ölkəmizdə ən populyar platformadır. Burada minlərlə oyun və Aviator var. Pulu kartınıza tez köçürürlər. Mobil tətbiqi də var, telefondan oynamaq çox rahatdır. Giriş linki Pin Up AZ yoxlayın.

Pin-Up AZ Azərbaycanda ən populyar platformadır. Burada çoxlu slotlar və Aviator var. Pulu kartınıza anında köçürürlər. Proqramı də var, telefondan oynamaq çox rahatdır. Giriş linki Pin Up rəsmi sayt yoxlayın.

п»їHalo Slotter, lagi nyari situs slot yang mudah menang? Coba main di Bonaslot. RTP Live tertinggi hari ini dan pasti bayar. Isi saldo bisa pakai Dana tanpa potongan. Login disini: п»їBonaslot link alternatif semoga maxwin.

п»їHalo Bosku, cari situs slot yang mudah menang? Coba main di Bonaslot. Winrate tertinggi hari ini dan terbukti membayar. Deposit bisa pakai OVO tanpa potongan. Daftar sekarang: п»їdaftar situs judi slot semoga maxwin.

Pin-Up AZ ölkəmizdə ən populyar kazino saytıdır. Saytda minlərlə oyun və canlı dilerlər var. Qazancı kartınıza anında köçürürlər. Mobil tətbiqi də var, telefondan oynamaq çox rahatdır. Rəsmi sayt Pin Up AZ baxın.

Pin-Up AZ Azərbaycanda ən populyar kazino saytıdır. Saytda çoxlu slotlar və canlı dilerlər var. Qazancı kartınıza tez köçürürlər. Proqramı də var, telefondan oynamaq çox rahatdır. Rəsmi sayt burada tövsiyə edirəm.

Bocoran slot gacor hari ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Website ini anti rungkad dan aman. Promo menarik menanti anda. Kunjungi: п»їBonaslot raih kemanangan.

Salam dostlar, siz də etibarlı kazino axtarırsınızsa, mütləq Pin Up saytını yoxlayasınız. Yüksək əmsallar və rahat pul çıxarışı burada mövcuddur. İndi qoşulun və ilk depozit bonusunu götürün. Daxil olmaq üçün link: bura daxil olun uğurlar hər kəsə!

Pin Up Casino ölkəmizdə ən populyar platformadır. Burada minlərlə oyun və canlı dilerlər var. Pulu kartınıza anında köçürürlər. Mobil tətbiqi də var, telefondan oynamaq çox rahatdır. Giriş linki rəsmi sayt baxın.

Hər vaxtınız xeyir, siz də etibarlı kazino axtarırsınızsa, mütləq Pin Up saytını yoxlayasınız. Yüksək əmsallar və sürətli ödənişlər burada mövcuddur. İndi qoşulun və ilk depozit bonusunu götürün. Oynamaq üçün link: https://pinupaz.jp.net/# ətraflı məlumat uğurlar hər kəsə!

2026 yılında popüler olan casino siteleri hangileri? Cevabı web sitemizde mevcuttur. Deneme bonusu veren siteleri ve güncel giriş linklerini paylaşıyoruz. İncelemek için cassiteleri.us.org kazanmaya başlayın.

2026 yılında en çok kazandıran casino siteleri hangileri? Cevabı web sitemizde mevcuttur. Bedava bahis veren siteleri ve güncel giriş linklerini paylaşıyoruz. İncelemek için casino siteleri 2026 kazanmaya başlayın.

Bonaslot adalah agen judi slot online terpercaya di Indonesia. Banyak member sudah mendapatkan Maxwin sensasional disini. Transaksi super cepat kilat. Link alternatif п»їhttps://bonaslotind.us.com/# Bonaslot daftar gas sekarang bosku.

Selamlar, sağlam casino siteleri arıyorsanız, bu siteye kesinlikle göz atın. Lisanslı firmaları ve bonusları sizin için listeledik. Güvenli oyun için doğru adres: türkçe casino siteleri iyi kazançlar.

Bu sene en çok kazandıran casino siteleri hangileri? Cevabı platformumuzda mevcuttur. Bedava bahis veren siteleri ve güncel giriş linklerini paylaşıyoruz. Hemen tıklayın listeyi gör fırsatı kaçırmayın.

Canlı casino oynamak isteyenler için rehber niteliğinde bir site: en iyi casino siteleri Hangi site güvenilir diye düşünmeyin. Onaylı casino siteleri listesi ile sorunsuz oynayın. Detaylar linkte.

Bocoran slot gacor hari ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Website ini gampang menang dan resmi. Promo menarik menanti anda. Akses link: п»їhttps://bonaslotind.us.com/# Bonaslot link alternatif dan menangkan.

Salamlar, əgər siz etibarlı kazino axtarırsınızsa, məsləhətdir ki, Pin Up saytını yoxlayasınız. Yüksək əmsallar və sürətli ödənişlər burada mövcuddur. İndi qoşulun və ilk depozit bonusunu götürün. Sayta keçmək üçün link: Pin Up rəsmi sayt uğurlar hər kəsə!

Yeni Pin Up giriş ünvanını axtarırsınızsa, bura baxa bilərsiniz. Bloklanmayan link vasitəsilə qeydiyyat olun və qazanmağa başlayın. Pulsuz fırlanmalar sizi gözləyir. Keçid: Pin Up giriş qazancınız bol olsun.

Bu sene popüler olan casino siteleri hangileri? Detaylı liste web sitemizde mevcuttur. Bedava bahis veren siteleri ve yeni adres linklerini paylaşıyoruz. İncelemek için kaçak bahis siteleri fırsatı kaçırmayın.

Salam dostlar, əgər siz yaxşı kazino axtarırsınızsa, mütləq Pin Up saytını yoxlayasınız. Canlı oyunlar və sürətli ödənişlər burada mövcuddur. İndi qoşulun və bonus qazanın. Sayta keçmək üçün link: Pin Up rəsmi sayt uğurlar hər kəsə!

Canlı casino oynamak isteyenler için kılavuz niteliğinde bir site: türkçe casino siteleri Hangi site güvenilir diye düşünmeyin. Onaylı bahis siteleri listesi ile rahatça oynayın. Detaylar linkte.

Info slot gacor hari ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Website ini anti rungkad dan resmi. Bonus new member menanti anda. Kunjungi: https://bonaslotind.us.com/# daftar situs judi slot dan menangkan.

Pin-Up AZ ölkəmizdə ən populyar kazino saytıdır. Burada minlərlə oyun və canlı dilerlər var. Pulu kartınıza anında köçürürlər. Mobil tətbiqi də var, telefondan oynamaq çox rahatdır. Giriş linki sayta keçid yoxlayın.

Pin-Up AZ Azərbaycanda ən populyar platformadır. Burada minlərlə oyun və Aviator var. Pulu kartınıza tez köçürürlər. Mobil tətbiqi də var, telefondan oynamaq çox rahatdır. Rəsmi sayt https://pinupaz.jp.net/# Pin Up yüklə baxın.

Bocoran slot gacor malam ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Situs ini gampang menang dan aman. Bonus new member menanti anda. Kunjungi: п»їslot gacor dan menangkan.

Selam, sağlam casino siteleri bulmak istiyorsanız, hazırladığımız listeye mutlaka göz atın. Lisanslı firmaları ve fırsatları sizin için inceledik. Güvenli oyun için doğru adres: https://cassiteleri.us.org/# cassiteleri.us.org iyi kazançlar.

Selam, güvenilir casino siteleri arıyorsanız, bu siteye mutlaka göz atın. En iyi firmaları ve fırsatları sizin için listeledik. Güvenli oyun için doğru adres: casino siteleri bol şanslar.

Canlı casino oynamak isteyenler için kılavuz niteliğinde bir site: casino siteleri Hangi site güvenilir diye düşünmeyin. Editörlerimizin seçtiği casino siteleri listesi ile sorunsuz oynayın. Detaylar linkte.

Salamlar, əgər siz yaxşı kazino axtarırsınızsa, məsləhətdir ki, Pin Up saytını yoxlayasınız. Yüksək əmsallar və rahat pul çıxarışı burada mövcuddur. Qeydiyyatdan keçin və ilk depozit bonusunu götürün. Oynamaq üçün link: https://pinupaz.jp.net/# Pin Up Azerbaijan uğurlar hər kəsə!

Situs Bonaslot adalah agen judi slot online terpercaya di Indonesia. Ribuan member sudah mendapatkan Maxwin sensasional disini. Transaksi super cepat hanya hitungan menit. Link alternatif п»їhttps://bonaslotind.us.com/# Bonaslot slot gas sekarang bosku.

Canlı casino oynamak isteyenler için kılavuz niteliğinde bir site: buraya tıkla Nerede oynanır diye düşünmeyin. Onaylı bahis siteleri listesi ile sorunsuz oynayın. Tüm liste linkte.

Info slot gacor hari ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Website ini gampang menang dan resmi. Bonus new member menanti anda. Akses link: Bonaslot dan menangkan.

Bocoran slot gacor hari ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Situs ini anti rungkad dan resmi. Bonus new member menanti anda. Kunjungi: п»їhttps://bonaslotind.us.com/# Bonaslot rtp raih kemanangan.

Bonaslot adalah agen judi slot online nomor 1 di Indonesia. Banyak member sudah mendapatkan Jackpot sensasional disini. Proses depo WD super cepat kilat. Link alternatif п»їslot gacor gas sekarang bosku.

Merhaba arkadaşlar, sağlam casino siteleri bulmak istiyorsanız, hazırladığımız listeye mutlaka göz atın. Lisanslı firmaları ve bonusları sizin için inceledik. Güvenli oyun için doğru adres: güvenilir casino siteleri bol şanslar.

Salam dostlar, siz dÉ™ etibarlı kazino axtarırsınızsa, mÉ™slÉ™hÉ™tdir ki, Pin Up saytını yoxlayasınız. Æn yaxşı slotlar vÉ™ sürÉ™tli ödÉ™niÅŸlÉ™r burada mövcuddur. Ä°ndi qoÅŸulun vÉ™ ilk depozit bonusunu götürün. Sayta keçmÉ™k üçün link: https://pinupaz.jp.net/# bura daxil olun uÄŸurlar hÉ™r kÉ™sÉ™!

Salamlar, siz də etibarlı kazino axtarırsınızsa, məsləhətdir ki, Pin Up saytını yoxlayasınız. Yüksək əmsallar və sürətli ödənişlər burada mövcuddur. Qeydiyyatdan keçin və ilk depozit bonusunu götürün. Daxil olmaq üçün link: Pin Up yüklə uğurlar hər kəsə!

Info slot gacor hari ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Situs ini gampang menang dan aman. Promo menarik menanti anda. Akses link: Bonaslot link alternatif dan menangkan.

Info slot gacor hari ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Website ini anti rungkad dan resmi. Promo menarik menanti anda. Kunjungi: https://bonaslotind.us.com/# Bonaslot link alternatif raih kemanangan.

Merhaba arkadaşlar, sağlam casino siteleri bulmak istiyorsanız, hazırladığımız listeye kesinlikle göz atın. Lisanslı firmaları ve bonusları sizin için listeledik. Dolandırılmamak için doğru adres: en iyi casino siteleri bol şanslar.

Situs Bonaslot adalah bandar judi slot online terpercaya di Indonesia. Ribuan member sudah merasakan Maxwin sensasional disini. Transaksi super cepat kilat. Situs resmi п»їklik disini jangan sampai ketinggalan.

Bu sene popüler olan casino siteleri hangileri? Detaylı liste platformumuzda mevcuttur. Deneme bonusu veren siteleri ve yeni adres linklerini paylaşıyoruz. Hemen tıklayın kaçak bahis siteleri kazanmaya başlayın.

Bu sene en çok kazandıran casino siteleri hangileri? Cevabı platformumuzda mevcuttur. Bedava bahis veren siteleri ve yeni adres linklerini paylaşıyoruz. Hemen tıklayın listeyi gör kazanmaya başlayın.

Hi, I just found a useful source for meds for purchasing generics hassle-free. If you need cheap meds, this site is highly recommended. Great prices and no script needed. Visit here: international pharmacy online. Good luck!

Hey guys, I just found a great online drugstore to save on Rx. For those looking for cheap antibiotics safely, this site is worth checking. You get lowest prices worldwide. Visit here: https://indiapharm.in.net/#. Best regards.

To be honest, Just now discovered an amazing website for affordable pills. If you need ED meds at factory prices, this store is worth checking. You get wholesale rates to USA. More info here: https://indiapharm.in.net/#. Best regards.

Greetings, I just found a reliable source for meds to order pills cheaply. For those who need cheap meds, this store is very good. They ship globally plus huge selection. See for yourself: online pharmacy no prescription. Sincerely.

Hi all, Just now stumbled upon a useful online drugstore for affordable pills. For those looking for cheap antibiotics without prescription, this site is the best place. It has wholesale rates to USA. Check it out: https://indiapharm.in.net/#. Hope it helps.

To be honest, Just now ran into a trusted resource to buy medication. If you are tired of high prices and need cheap antibiotics, this site is worth checking out. No prescription needed and very reliable. Visit here: https://pharm.mex.com/#. Many thanks.

Hey everyone, I recently discovered an excellent online drugstore for purchasing medications hassle-free. For those who need no prescription drugs, this site is highly recommended. They ship globally plus no script needed. Visit here: online pharmacy usa. Sincerely.

Hello, I just discovered a great Indian pharmacy for affordable pills. If you want to buy cheap antibiotics at factory prices, this site is the best place. They offer fast shipping to USA. Visit here: safe indian pharmacy. Good luck.

To be honest, Just now came across an awesome website to buy medication. For those seeking and need generic drugs, this site is highly recommended. Great prices and it is safe. Visit here: Pharm Mex. Sincerely.

Hello everyone, I recently came across an awesome Mexican pharmacy to buy medication. For those seeking and need affordable prescriptions, this site is worth checking out. Fast shipping and very reliable. Visit here: Pharm Mex. Peace.

Hey there, I wanted to share a great website to order prescription drugs securely. If you are looking for cheap meds, this site is very good. They ship globally plus it is very affordable. See for yourself: online pharmacy usa. All the best.

Hello everyone, Just now found a great Mexican pharmacy to buy medication. If you want to save money and want affordable prescriptions, Pharm Mex is highly recommended. Great prices and very reliable. Check it out: safe mexican pharmacy. Have a nice day.

To be honest, I just found a reliable online source for cheap meds. For those seeking and want cheap antibiotics, this store is a game changer. No prescription needed and very reliable. Check it out: https://pharm.mex.com/#. Thx.

Greetings, I wanted to share an excellent source for meds for purchasing prescription drugs hassle-free. For those who need safe pharmacy delivery, this store is worth a look. Fast delivery plus no script needed. Check it out: this site. Have a good one.

Hey there, I just came across a great website for affordable pills. If you are tired of high prices and want affordable prescriptions, this site is worth checking out. No prescription needed and very reliable. Link is here: pharm.mex.com. Stay healthy.

Hello, Lately found a useful website to save on Rx. If you want to buy ED meds at factory prices, this store is highly recommended. They offer lowest prices worldwide. Visit here: safe indian pharmacy. Cheers.

Hey everyone, To be honest, I found a reliable source for meds where you can buy prescription drugs securely. If you need antibiotics, this site is very good. Secure shipping plus it is very affordable. Check it out: https://onlinepharm.jp.net/#. Regards.

Greetings, To be honest, I found a reliable website for purchasing pills cheaply. For those who need antibiotics, this store is very good. Great prices plus no script needed. Check it out: online pharmacy no prescription. Hope this helps!

To be honest, I just discovered a great Indian pharmacy to buy generics. For those looking for generic pills without prescription, IndiaPharm is highly recommended. They offer lowest prices guaranteed. Take a look: indian pharmacy. Best regards.

Hello everyone, Just now came across a reliable resource for cheap meds. If you want to save money and want affordable prescriptions, Pharm Mex is highly recommended. No prescription needed and secure. Link is here: mexican pharmacy. Have a great week.

Greetings, I recently discovered a great source for meds where you can buy medications securely. If you need cheap meds, this store is worth a look. Secure shipping plus it is very affordable. Check it out: https://onlinepharm.jp.net/#. Peace.

Hey guys, Just now stumbled upon a useful Indian pharmacy for affordable pills. If you want to buy generic pills without prescription, this site is the best place. They offer fast shipping to USA. Visit here: order medicines from india. Best regards.

Hey there, I recently discovered a useful website to order generics online. For those who need antibiotics, OnlinePharm is highly recommended. Fast delivery plus huge selection. Visit here: https://onlinepharm.jp.net/#. Get well soon.

Hi guys, I recently discovered a trusted online source to save on Rx. For those seeking and want affordable prescriptions, Pharm Mex is worth checking out. No prescription needed plus secure. Visit here: cheap antibiotics mexico. Peace.

Hey there, I wanted to share a useful international pharmacy to order medications cheaply. If you are looking for cheap meds, this site is the best choice. Great prices plus no script needed. Visit here: click here. Thanks!

To be honest, Just now stumbled upon a useful online drugstore for cheap meds. If you want to buy ED meds cheaply, this site is very reliable. You get fast shipping to USA. Take a look: buy meds from india. Hope it helps.

Hey everyone, I wanted to share an excellent source for meds to order prescription drugs hassle-free. If you are looking for no prescription drugs, this site is the best choice. Great prices and no script needed. See for yourself: https://onlinepharm.jp.net/#. Best regards.

Hey there, I recently came across a reliable website for cheap meds. If you want to save money and need cheap antibiotics, this store is the best option. Fast shipping plus secure. Take a look: https://pharm.mex.com/#. Thx.

Hi guys, I recently ran into an awesome Mexican pharmacy for affordable pills. If you want to save money and want generic drugs, Pharm Mex is a game changer. Great prices and very reliable. Check it out: https://pharm.mex.com/#. Cheers.

Greetings, I wanted to share a reliable source for meds for purchasing medications cheaply. For those who need antibiotics, this site is very good. Secure shipping and it is very affordable. Visit here: read more. Be well.

Hey there, I wanted to share a reliable website to order medications hassle-free. If you need antibiotics, this site is the best choice. Fast delivery and no script needed. Check it out: click here. Hope this was useful.

Hey guys, Just now came across a great source from India for affordable pills. If you want to buy cheap antibiotics safely, this store is the best place. It has secure delivery to USA. More info here: order medicines from india. Hope it helps.

Hi guys, I just discovered an awesome Mexican pharmacy to buy medication. For those seeking and need affordable prescriptions, this store is highly recommended. They ship to USA plus secure. Check it out: safe mexican pharmacy. Regards.

Greetings, Just now came across a great website to buy medication. For those seeking and want affordable prescriptions, Pharm Mex is a game changer. Fast shipping plus secure. Take a look: check availability. Good luck!

Hey there, I wanted to share a great online drugstore for purchasing prescription drugs cheaply. If you are looking for no prescription drugs, this site is highly recommended. They ship globally and huge selection. See for yourself: cheap pharmacy online. Kind regards.

Hello, To be honest, I found an excellent international pharmacy to order pills online. For those who need antibiotics, this site is very good. They ship globally plus huge selection. Check it out: Online Pharm Store. Best of luck.

Hey guys, Just now found a useful website for cheap meds. If you want to buy cheap antibiotics at factory prices, this site is very reliable. It has fast shipping guaranteed. Visit here: cheap indian generics. Best regards.

Greetings, I recently found the best source from India to buy generics. If you want to buy cheap antibiotics at factory prices, this site is highly recommended. They offer secure delivery guaranteed. Take a look: cheap indian generics. Good luck.

To be honest, I recently came across an amazing website for cheap meds. If you want to buy medicines from India without prescription, IndiaPharm is very reliable. It has wholesale rates worldwide. Check it out: https://indiapharm.in.net/#. Good luck.

To be honest, Lately came across an awesome Mexican pharmacy to buy medication. For those seeking and need generic drugs, this site is a game changer. Great prices plus secure. Take a look: buy meds from mexico. Hope it helps.

Greetings, I recently came across an amazing Indian pharmacy for affordable pills. If you want to buy medicines from India without prescription, this site is very reliable. They offer lowest prices to USA. More info here: https://indiapharm.in.net/#. Cheers.

Hey guys, I just came across an amazing source from India for affordable pills. If you want to buy generic pills at factory prices, this store is highly recommended. You get lowest prices guaranteed. More info here: visit website. Good luck.

Greetings, Just now found a useful source from India for affordable pills. If you want to buy cheap antibiotics without prescription, this site is worth checking. They offer secure delivery guaranteed. Check it out: buy meds from india. Hope it helps.

Hi guys, I just came across a reliable Mexican pharmacy for cheap meds. For those seeking and want meds from Mexico, this store is a game changer. Fast shipping and very reliable. Visit here: this site. Good luck with everything.

Hi all, Lately stumbled upon an amazing source from India for affordable pills. If you need generic pills without prescription, IndiaPharm is worth checking. You get fast shipping worldwide. More info here: this site. Good luck.

Greetings, Just now came across the best online drugstore to save on Rx. If you want to buy ED meds safely, this site is highly recommended. It has lowest prices to USA. Take a look: click here. Good luck.

To be honest, Lately came across the best Indian pharmacy to buy generics. If you want to buy cheap antibiotics without prescription, IndiaPharm is the best place. They offer lowest prices worldwide. Check it out: https://indiapharm.in.net/#. Good luck.

Hey there, Lately came across a reliable resource to save on Rx. For those seeking and want cheap antibiotics, this site is the best option. They ship to USA plus it is safe. Take a look: pharm.mex.com. Cheers.

To be honest, I just came across a great source from India for affordable pills. For those looking for generic pills cheaply, this site is the best place. They offer lowest prices to USA. Visit here: buy meds from india. Best regards.

Hey guys, Just now came across an amazing Indian pharmacy for cheap meds. If you need ED meds at factory prices, IndiaPharm is the best place. It has fast shipping to USA. More info here: indian pharmacy. Cheers.

Gencler, Grandpashabet yeni adresi ac?kland?. Giremeyenler su linkten devam edebilir T?kla Git

Grandpashabet giriş adresi arıyorsanız işte burada. Hızlı giriş yapmak için Grandpashabet 2026 Deneme bonusu burada.

Herkese merhaba, bu site kullanıcıları adına kısa bir duyuru paylaşıyorum. Bildiğiniz gibi Vaycasino giriş linkini tekrar güncelledi. Giriş hatası varsa panik yapmayın. Çalışan siteye erişim linki şu an burada: Vaycasino Sorunsuz Giriş Paylaştığım bağlantı ile vpn kullanmadan siteye girebilirsiniz. Lisanslı bahis deneyimi için Vay Casino tercih edebilirsiniz. Tüm forum üyelerine bol şans temenni ederim.

Bahis severler selam, bu populer site oyuncular? ad?na onemli bir duyuru yapmak istiyorum. Herkesin bildigi uzere Casibom giris linkini BTK engeli yuzunden surekli guncelledi. Erisim hatas? yas?yorsan?z link asag?da. Son Casibom giris linki su an burada Casibom Kay?t Bu link uzerinden dogrudan hesab?n?za girebilirsiniz. Ayr?ca yeni uyelere sunulan yat?r?m bonusu f?rsatlar?n? da kac?rmay?n. Guvenilir casino keyfi surdurmek icin Casibom dogru adres. Tum forum uyelerine bol sans dilerim.

Gencler, Grandpashabet son linki belli oldu. Adresi bulamayanlar buradan giris yapabilir Grandpashabet Yeni Adres

Arkadaşlar, Grandpashabet Casino yeni adresi açıklandı. Adresi bulamayanlar şu linkten giriş yapabilir Grandpashabet Sorunsuz Giriş

Matbet guncel linki laz?msa iste burada. Sorunsuz icin: Matbet Sorunsuz Giris Yuksek oranlar bu sitede. Arkadaslar, Matbet son linki belli oldu.

Dostlar selam, bu site oyuncuları için kısa bir bilgilendirme yapmak istiyorum. Malum Vaycasino giriş linkini yine güncelledi. Giriş hatası yaşıyorsanız panik yapmayın. Son siteye erişim linki şu an burada: Tıkla Git Bu link ile vpn kullanmadan hesabınıza erişebilirsiniz. Lisanslı bahis deneyimi sürdürmek için Vaycasino tercih edebilirsiniz. Tüm forum üyelerine bol şans temenni ederim.

Grandpashabet giris adresi ar?yorsan?z iste burada. H?zl? erisim icin Grandpashabet Mobil Yuksek oranlar burada.

Dostlar selam, Vaycasino oyuncuları adına kısa bir duyuru yapmak istiyorum. Malum platform adresini tekrar değiştirdi. Erişim sorunu yaşıyorsanız endişe etmeyin. Çalışan Vay Casino giriş linki şu an aşağıdadır: Vaycasino İndir Bu link üzerinden doğrudan hesabınıza erişebilirsiniz. Güvenilir casino keyfi için Vay Casino tercih edebilirsiniz. Herkese bol şans dilerim.

Arkadaslar, Grandpashabet Casino yeni adresi ac?kland?. Adresi bulamayanlar buradan devam edebilir Grandpashabet Guvenilir mi

Matbet güncel adresi arıyorsanız işte burada. Sorunsuz için: Matbet İndir Yüksek oranlar burada. Gençler, Matbet bahis son linki açıklandı.

Grandpashabet giris linki ar?yorsan?z dogru yerdesiniz. Sorunsuz giris yapmak icin https://grandpashabet.in.net/# Yuksek oranlar burada.

Gençler, Grandpashabet Casino yeni adresi açıklandı. Adresi bulamayanlar buradan devam edebilir Grandpashabet Giriş

Grandpasha guncel linki ar?yorsan?z iste burada. Sorunsuz giris yapmak icin Grandpashabet Yeni Adres Deneme bonusu burada.

Gencler, Grandpashabet Casino son linki ac?kland?. Giremeyenler buradan devam edebilir https://grandpashabet.in.net/#

Matbet güncel linki lazımsa işte burada. Sorunsuz için: Resmi Site Canlı maçlar burada. Gençler, Matbet bahis son linki belli oldu.

Herkese merhaba, bu populer site kullan?c?lar? ad?na k?sa bir bilgilendirme paylas?yorum. Bildiginiz gibi site domain adresini erisim k?s?tlamas? nedeniyle yine degistirdi. Giris problemi cekenler icin cozum burada. Son siteye erisim linki su an paylas?yorum Casibom Guncel Giris Bu link uzerinden dogrudan hesab?n?za erisebilirsiniz. Ayr?ca yeni uyelere sunulan yat?r?m bonusu kampanyalar?n? da inceleyin. Guvenilir casino deneyimi icin Casibom dogru adres. Tum forum uyelerine bol sans dilerim.

Dostlar selam, bu site kullanıcıları için önemli bir bilgilendirme paylaşıyorum. Malum platform adresini tekrar değiştirdi. Erişim hatası yaşıyorsanız endişe etmeyin. Yeni siteye erişim adresi artık burada: Vaycasino Twitter Bu link ile doğrudan siteye girebilirsiniz. Güvenilir casino keyfi için Vaycasino tercih edebilirsiniz. Herkese bol kazançlar dilerim.

Herkese selam, Vaycasino kullan?c?lar? icin k?sa bir bilgilendirme yapmak istiyorum. Malum site adresini yine degistirdi. Erisim hatas? varsa panik yapmay?n. Cal?san Vaycasino giris linki art?k asag?dad?r: Giris Yap Bu link uzerinden vpn kullanmadan siteye girebilirsiniz. Guvenilir bahis keyfi surdurmek icin Vay Casino tercih edebilirsiniz. Herkese bol kazanclar dilerim.

Matbet TV guncel linki laz?msa iste burada. Sorunsuz icin: Matbet Giris Yuksek oranlar burada. Gencler, Matbet son linki ac?kland?.

Arkadaşlar, Grandpashabet yeni adresi belli oldu. Adresi bulamayanlar şu linkten devam edebilir https://grandpashabet.in.net/#

Matbet giris linki laz?msa iste burada. Mac izlemek icin t?kla: https://matbet.jp.net/# Canl? maclar bu sitede. Arkadaslar, Matbet bahis son linki ac?kland?.

Arkadaşlar selam, bu popüler site oyuncuları adına önemli bir duyuru paylaşıyorum. Bildiğiniz gibi Casibom domain adresini BTK engeli yüzünden sürekli güncelledi. Erişim problemi çekenler için link aşağıda. Çalışan Casibom giriş linki artık aşağıdadır https://casibom.mex.com/# Paylaştığım bağlantı üzerinden vpn kullanmadan hesabınıza girebilirsiniz. Ayrıca yeni üyelere verilen freespin kampanyalarını da kaçırmayın. En iyi slot deneyimi sürdürmek için Casibom doğru adres. Herkese bol kazançlar dilerim.

Matbet TV guncel adresi ar?yorsan?z dogru yerdesiniz. Sorunsuz icin: T?kla Git Canl? maclar burada. Gencler, Matbet bahis son linki belli oldu.

Grandpashabet giriş linki arıyorsanız işte burada. Hızlı giriş yapmak için https://grandpashabet.in.net/# Yüksek oranlar burada.

Matbet giris adresi ar?yorsan?z dogru yerdesiniz. H?zl? icin t?kla: T?kla Git Canl? maclar burada. Gencler, Matbet bahis yeni adresi ac?kland?.

Matbet TV giris adresi ar?yorsan?z iste burada. Mac izlemek icin t?kla: https://matbet.jp.net/# Yuksek oranlar bu sitede. Gencler, Matbet bahis yeni adresi belli oldu.

Dostlar selam, bu site kullan?c?lar? ad?na k?sa bir duyuru yapmak istiyorum. Bildiginiz gibi site giris linkini yine degistirdi. Erisim hatas? yas?yorsan?z endise etmeyin. Cal?san Vaycasino giris adresi art?k burada: https://vaycasino.us.com/# Bu link ile vpn kullanmadan siteye girebilirsiniz. Guvenilir casino deneyimi surdurmek icin Vaycasino dogru adres. Tum forum uyelerine bol kazanclar temenni ederim.

Hello m?i ngu?i, ai dang tim ch? n?p rut nhanh d? gi?i tri Da Ga thi tham kh?o trang nay nhe. Dang co khuy?n mai: Nha cai BJ88. V? b? thanh cong.

Xin chao 500 anh em, n?u anh em dang ki?m c?ng game khong b? ch?n d? cay cu?c Da Ga d?ng b? qua ch? nay. N?p rut 1-1: sun win. Hup l?c d?y nha.

Xin chao 500 anh em, n?u anh em dang ki?m c?ng game khong b? ch?n d? choi N? Hu thi vao ngay ch? nay. Uy tin luon: https://homemaker.org.in/#. Chuc cac bac r?c r?.

Chào anh em, người anh em nào cần trang chơi xanh chín để cày cuốc Game bài thì vào ngay trang này nhé. Uy tín luôn: sunwin. Chúc anh em may mắn.

Xin chào 500 anh em, ai đang tìm nhà cái uy tín để giải trí Game bài đừng bỏ qua chỗ này. Uy tín luôn: https://gramodayalawcollege.org.in/#. Chiến thắng nhé.

Hello m?i ngu?i, n?u anh em dang ki?m trang choi xanh chin d? cay cu?c Game bai thi xem th? con hang nay. Uy tin luon: Nha cai BJ88. Hup l?c d?y nha.

Chào anh em, ai đang tìm trang chơi xanh chín để cày cuốc Tài Xỉu thì xem thử địa chỉ này. Đang có khuyến mãi: Link vào Dola789. Chiến thắng nhé.

Hi các bác, người anh em nào cần cổng game không bị chặn để chơi Casino thì vào ngay trang này nhé. Nạp rút 1-1: Đăng nhập BJ88. Chúc các bác rực rỡ.

Hello m?i ngu?i, n?u anh em dang ki?m trang choi xanh chin d? g? g?c N? Hu thi xem th? trang nay nhe. Khong lo l?a d?o: Link t?i Sunwin. Hup l?c d?y nha.

Iver Protocols Guide: Iver Protocols Guide – Iver Protocols Guide

AmiTrip: Elavil – buy Elavil

fertility pct guide how to get cheap clomid price where to get clomid price

Follicle Insight: Follicle Insight – Follicle Insight

Iver Protocols Guide ivermectin brand name stromectol liquid

cheap propecia without a prescription: get propecia online – Follicle Insight

https://iver.us.com/# ivermectin 3 mg tabs

https://fertilitypctguide.us.com/# fertility pct guide

AmiTrip: buy Elavil – AmiTrip Relief Store

Please let me know if you’re looking for a article writer for your weblog. You have some really great articles and I believe I would be a good asset. If you ever want to take some of the load off, I’d absolutely love to write some articles for your blog in exchange for a link back to mine. Please blast me an e-mail if interested. Many thanks!

stromectol pill: Iver Protocols Guide – ivermectin lotion for lice

https://follicle.us.com/# Follicle Insight

Iver Protocols Guide: Iver Protocols Guide – ivermectin 3mg pill

https://iver.us.com/# Iver Protocols Guide

Iver Protocols Guide Iver Protocols Guide Iver Protocols Guide

where to get clomid pills: fertility pct guide – where buy generic clomid no prescription

https://iver.us.com/# cost of ivermectin cream

get propecia without rx: cost of generic propecia without rx – Follicle Insight

AmiTrip Relief Store: AmiTrip – Amitriptyline

https://amitrip.us.com/# Amitriptyline

https://follicle.us.com/# cost of cheap propecia without insurance

Amitriptyline: AmiTrip Relief Store – Amitriptyline

ivermectin 10 ml Iver Protocols Guide Iver Protocols Guide

ivermectin cost canada: buy stromectol uk – generic stromectol

https://fertilitypctguide.us.com/# can i purchase cheap clomid

fertility pct guide: fertility pct guide – fertility pct guide

https://follicle.us.com/# Follicle Insight

can i get generic clomid without a prescription: fertility pct guide – fertility pct guide

how to buy cheap clomid: where to buy cheap clomid without prescription – fertility pct guide

Elavil: Amitriptyline – Elavil

https://amitrip.us.com/# AmiTrip

https://fertilitypctguide.us.com/# fertility pct guide

Iver Protocols Guide stromectol order online stromectol 3 mg tablet

cost generic propecia: cost of propecia for sale – Follicle Insight

can you buy cheap clomid without rx: fertility pct guide – how to get cheap clomid pills

https://iver.us.com/# ivermectin 18mg

Iver Protocols Guide: Iver Protocols Guide – Iver Protocols Guide

https://iver.us.com/# Iver Protocols Guide

https://fertilitypctguide.us.com/# how to buy cheap clomid without prescription

cost generic propecia without prescription: order cheap propecia – Follicle Insight

Generic Elavil AmiTrip Amitriptyline

https://amitrip.us.com/# Generic Elavil

Iver Protocols Guide: Iver Protocols Guide – where to buy ivermectin pills

https://amitrip.us.com/# Elavil

Iver Protocols Guide: Iver Protocols Guide – price of ivermectin

https://amitrip.us.com/# AmiTrip Relief Store

AmiTrip Relief Store: Generic Elavil – Elavil

Hi guys, anyone searching for a reliable source for meds to buy prescription drugs online. I recommend this pharmacy: clarinex. Selling high quality drugs and huge discounts. Thanks.

Hello, if anyone needs dosage instructions regarding health treatments, take a look at this health wiki. It explains safety protocols in detail. Reference: https://magmaxhealth.com/Allopurinol. Hope it helps.

To understand the proper usage instructions, data is available at the detailed guide on: https://magmaxhealth.com/flonase.html to ensure risk management.

Greetings, if anyone needs side effects info regarding various medications, I found this drug database. You can read about usage and risks clearly. Reference: https://magmaxhealth.com/Protonix. Hope this is useful.

Hi guys, anyone searching for an affordable online pharmacy to purchase pills online. Check out this site: clarinex. They offer high quality drugs at the best prices. Best regards.

Greetings, if anyone needs detailed information about various medications, take a look at this medical reference. It covers usage and risks in detail. Source: https://magmaxhealth.com/Flonase. Hope it helps.

For a trusted source, I recommend this top-rated pharmacy here for fast USA shipping. Stop overpaying hassle-free.

To start saving, visit this reliable site pharmacy online usa for fast USA shipping. Stop overpaying hassle-free.

Greetings, if you are looking for a reliable source for meds to purchase pills hassle-free. Check out MagMaxHealth: prilosec. Selling generic tablets with fast shipping. Best regards.

Hi all, if you are looking for dosage instructions regarding various medications, I recommend this medical reference. It explains usage and risks very well. Reference: https://magmaxhealth.com/Lamictal. Good info.

For a complete overview of safety protocols, you can consult the detailed guide on: https://magmaxhealth.com/celebrex.html to ensure safe treatment.

regarding the side effects and interactions, it is recommended to check this resource: https://magmaxhealth.com/lipitor.html which covers safe treatment.

Hey everyone, I wanted to share an affordable source for meds to buy medicines cheaply. I found this pharmacy: clomid. Selling generic tablets with fast shipping. Good luck.

Hi all, I recently found a medical guide regarding various medications, check out this medical reference. It explains drug interactions clearly. Link: https://magmaxhealth.com/Naltrexone. Hope this is useful.

Hey everyone, if anyone needs a useful article regarding health treatments, check out this medical reference. It explains safety protocols in detail. See details: https://magmaxhealth.com/Protonix. Hope this is useful.

Greetings, I wanted to share a reliable health store to order medicines online. Take a look at this site: meclizine. Stocking high quality drugs with fast shipping. Good luck.

Greetings, I recently found a medical guide on prescription drugs, check out this online directory. You can read about drug interactions in detail. Link: https://magmaxhealth.com/Allopurinol. Good info.

In terms of proper usage instructions, it is recommended to check the official information page at: https://magmaxhealth.com/buspar.html for risk management.

Hi, if anyone needs a medical guide regarding prescription drugs, take a look at this drug database. It explains safety protocols in detail. Source: https://magmaxhealth.com/Lipitor. Thanks.

Greetings, for those searching for detailed information about prescription drugs, take a look at this useful resource. You can read about how to take meds clearly. Read more here: https://magmaxhealth.com/Clarinex. Hope it helps.

In terms of dosage guidelines, please review the detailed guide on: https://magmaxhealth.com/celebrex.html which covers clinical details.

zofran medication: ondansetron – Nausea Care US

methocarbamol medication: robaxin medication – robaxin

https://gastrohealthmonitor.com/# prilosec side effects

ondansetron zofran: Nausea Care US – Nausea Care US

Gastro Health Monitor: Gastro Health Monitor – Gastro Health Monitor

buy tizanidine without prescription: Spasm Relief Protocols – tizanidine medication

generic zofran: Nausea Care US – ondansetron otc

buy methocarbamol without prescription Spasm Relief Protocols robaxin generic

https://nauseacareus.shop/# zofran medication

omeprazole over the counter: prilosec side effects – omeprazole brand name

muscle relaxant drugs: tizanidine hcl – tizanidine generic

omeprazole medication: omeprazole otc – Gastro Health Monitor

https://spasmreliefprotocols.shop/# muscle relaxant drugs

prilosec medication: omeprazole prilosec – generic prilosec

Gastro Health Monitor: prilosec side effects – omeprazole medication

ondestranon zofran: Nausea Care US – ondansetron zofran

https://nauseacareus.com/# Nausea Care US

Gastro Health Monitor: Gastro Health Monitor – Gastro Health Monitor

tizanidine zanaflex: antispasmodic medication – tizanidine hydrochloride

methocarbamol medication: zanaflex medication – robaxin

zanaflex: robaxin medication – tizanidine muscle relaxer

https://nauseacareus.shop/# п»їondansetron otc

Nausea Care US: Nausea Care US – zofran generic

omeprazole over the counter: Gastro Health Monitor – Gastro Health Monitor

zanaflex: Spasm Relief Protocols – tizanidine muscle relaxer

ondansetron zofran: Nausea Care US – Nausea Care US

prilosec side effects: Gastro Health Monitor – Gastro Health Monitor

https://nauseacareus.shop/# Nausea Care US

Gastro Health Monitor: Gastro Health Monitor – prilosec generic

tizanidine hcl: robaxin generic – methocarbamol robaxin

omeprazole generic: Gastro Health Monitor – Gastro Health Monitor

tizanidine hcl: robaxin generic – muscle relaxant drugs

https://nauseacareus.shop/# generic zofran

Gastro Health Monitor: Gastro Health Monitor – omeprazole medication

ondansetron: Nausea Care US – Nausea Care US

Gastro Health Monitor: Gastro Health Monitor – prilosec omeprazole

https://nauseacareus.shop/# buy zofran online

https://spasmreliefprotocols.shop/# methocarbamol robaxin

ondestranon zofran: zofran generic – Nausea Care US

http://nauseacareus.com/# Nausea Care US

tizanidine generic: antispasmodic medication – muscle relaxant drugs

https://nauseacareus.com/# zofran side effects

https://spasmreliefprotocols.com/# tizanidine medication

omeprazole: Gastro Health Monitor – prilosec side effects

https://nauseacareus.shop/# buy zofran online

buy zofran: ondansetron zofran – Nausea Care US

http://spasmreliefprotocols.com/# methocarbamol medication

muscle relaxer medication: tizanidine generic – muscle relaxer medication

https://usmedsoutlet.com/# US Meds Outlet

https://bajameddirect.shop/# mexican drug stores

india online pharmacy: cheapest online pharmacy india – india online pharmacy

https://indogenericexport.com/# Online medicine home delivery

https://indogenericexport.shop/# buy methocarbamol

mail order pharmacy no prescription: US Meds Outlet – medical pharmacy west

http://indogenericexport.com/# otc muscle relaxer

http://bajameddirect.com/# tijuana pharmacy online

canadian discount pharmacy: US Meds Outlet – offshore pharmacy no prescription

http://usmedsoutlet.com/# cheapest pharmacy canada

BajaMed Direct: BajaMed Direct – BajaMed Direct

https://indogenericexport.com/# tizanidine muscle relaxer

http://bajameddirect.com/# mexican pharma

canadian online pharmacy no prescription: drugstore com online pharmacy prescription drugs – cheapest prescription pharmacy

US Meds Outlet: canadian pharmacy ed medications – US Meds Outlet

BajaMed Direct: mexico meds – mexico pet pharmacy

https://bajameddirect.shop/# mexican pharmacy online

US Meds Outlet: legitimate canadian online pharmacies – canadian pharmacy 24h com

http://usmedsoutlet.com/# online pharmacy without prescription

india online pharmacy: india online pharmacy – online shopping pharmacy india

п»їlegitimate online pharmacies india: online shopping pharmacy india – pharmacy website india

https://indogenericexport.shop/# antispasmodic medication

indian pharmacy paypal: Indo-Generic Export – top online pharmacy india

reputable indian pharmacies: indianpharmacy com – online pharmacy india

http://bajameddirect.com/# BajaMed Direct

mail order pharmacy india: п»їlegitimate online pharmacies india – indian pharmacy

southern pharmacy: pharmacy discount card – worldwide pharmacy online

farmacia online usa: mexico meds – mexican pharmacy online

mexican pharmacy ship to usa: BajaMed Direct – BajaMed Direct

order meds from mexico: BajaMed Direct – mexican drug store

medical pharmacy west: online pharmacy products – indian pharmacy paypal

http://indogenericexport.com/# Online medicine home delivery

US Meds Outlet: US Meds Outlet – US Meds Outlet

top online pharmacy india: best india pharmacy – buy prescription drugs from india

http://usmedsoutlet.com/# reputable online pharmacy

best online pharmacy india: online shopping pharmacy india – Online medicine home delivery

Keep functioning ,impressive job!

indianpharmacy com: Indo-Generic Export – best online pharmacy india

http://bajameddirect.com/# mexico online farmacia

canadian pharmacy 365: canadian 24 hour pharmacy – US Meds Outlet

https://indogenericexport.com/# best india pharmacy

canadian pharmacy coupon: canadian pharmacy ed medications – US Meds Outlet

mexican drug store: BajaMed Direct – mexican pharmacies online

https://usmedsoutlet.com/# US Meds Outlet

india pharmacy mail order: US Meds Outlet – medical mall pharmacy

https://usmedsoutlet.shop/# US Meds Outlet

Online medicine order: Indo-Generic Export – reputable indian online pharmacy

mexican pharmacies online: BajaMed Direct – BajaMed Direct

https://bajameddirect.com/# BajaMed Direct

cheapest online pharmacy india: Indo-Generic Export – online pharmacy india

legit canadian online pharmacy: US Meds Outlet – online pharmacy no presc uk

https://indogenericexport.shop/# buy medicines online in india

BajaMed Direct: BajaMed Direct – mexican online pharmacy

https://ivertherapeutics.shop/# Iver Therapeutics

canadian pharmacy ltd: the pharmacy – global pharmacy canada

https://sertralineusa.shop/# zoloft cheap

Sertraline USA: zoloft no prescription – zoloft tablet

https://sertralineusa.com/# zoloft pill

sertraline generic: buy zoloft – generic zoloft

https://sertralineusa.com/# zoloft tablet

generic for zoloft: zoloft no prescription – zoloft tablet

https://ivertherapeutics.shop/# Iver Therapeutics

https://ivertherapeutics.shop/# purchase oral ivermectin

buy ivermectin nz: Iver Therapeutics – Iver Therapeutics

http://smartgenrxusa.com/# escrow pharmacy online

cost of ivermectin lotion: Iver Therapeutics – Iver Therapeutics

https://neuroreliefusa.com/# Neuro Relief USA

buy zoloft: sertraline – zoloft buy

http://smartgenrxusa.com/# pharmacy online australia free shipping

neurontin 100 mg cap: purchase neurontin canada – neurontin 200 mg price

https://neuroreliefusa.shop/# neurontin drug

zoloft buy: generic zoloft – zoloft generic

buy cheap neurontin Neuro Relief USA Neuro Relief USA

https://smartgenrxusa.shop/# canadian pharmacy uk delivery

neurontin 1200 mg: neurontin cost in canada – Neuro Relief USA

http://smartgenrxusa.com/# reputable canadian online pharmacies

zoloft without dr prescription: generic zoloft – zoloft tablet

buy ivermectin Iver Therapeutics Iver Therapeutics

https://ivertherapeutics.com/# Iver Therapeutics

buy zoloft: generic for zoloft – Sertraline USA

http://ivertherapeutics.com/# ivermectin over the counter

pharmacy discount card: on line pharmacy – Smart GenRx USA

http://sertralineusa.com/# Sertraline USA

neurontin sale: neurontin 4000 mg – Neuro Relief USA

gabapentin buy Neuro Relief USA Neuro Relief USA

https://sertralineusa.com/# buy zoloft

Neuro Relief USA: Neuro Relief USA – neurontin brand name 800mg

neurontin medicine: Neuro Relief USA – neurontin 204

https://ivertherapeutics.com/# ivermectin lotion

buy generic neurontin Neuro Relief USA Neuro Relief USA

generic for zoloft: Sertraline USA – order zoloft

https://smartgenrxusa.com/# Smart GenRx USA

zoloft no prescription: generic for zoloft – generic zoloft

https://neuroreliefusa.com/# Neuro Relief USA

ivermectin 1mg: ivermectin 500mg – stromectol without prescription

zoloft without dr prescription zoloft tablet sertraline

https://smartgenrxusa.shop/# canadian pharmacy 365

brand name neurontin price: neurontin without prescription – neurontin pills

http://neuroreliefusa.com/# neurontin singapore

Iver Therapeutics: ivermectin nz – ivermectin pills canada

https://smartgenrxusa.shop/# Smart GenRx USA

Sertraline USA zoloft pill generic zoloft

Smart GenRx USA: overseas pharmacy no prescription – Smart GenRx USA

https://sertralineusa.com/# zoloft without dr prescription

canadian pharmacy com: Smart GenRx USA – Smart GenRx USA

https://neuroreliefusa.com/# Neuro Relief USA

Smart GenRx USA: legitimate canadian pharmacy online – discount pharmacy

Sertraline USA sertraline zoloft zoloft buy

https://ivertherapeutics.com/# cost of ivermectin cream

zoloft without dr prescription: generic for zoloft – zoloft tablet

zoloft no prescription: zoloft no prescription – sertraline generic

Iver Therapeutics: Iver Therapeutics – Iver Therapeutics

order zoloft zoloft without rx zoloft without rx

http://neuroreliefusa.com/# Neuro Relief USA

Iver Therapeutics: stromectol price us – generic ivermectin

buy zoloft: sertraline – buy zoloft

https://smartgenrxusa.com/# which pharmacy is cheaper

sertraline zoloft: generic zoloft – zoloft pill

pharmacy canadian Smart GenRx USA Smart GenRx USA

https://smartgenrxusa.shop/# pharmacy wholesalers canada

https://sertralineusa.com/# zoloft pill

zoloft pill: buy zoloft – sertraline generic

https://smartgenrxusa.com/# Smart GenRx USA

Neuro Relief USA: Neuro Relief USA – Neuro Relief USA

https://smartgenrxusa.com/# Smart GenRx USA

world pharmacy india: Smart GenRx USA – indian pharmacy

Iver Therapeutics stromectol ireland Iver Therapeutics

http://smartgenrxusa.com/# trusted online pharmacy reviews

https://sertralineusa.com/# zoloft without rx

canada neurontin 100mg lowest price: neurontin 300 mg caps – Neuro Relief USA

https://smartgenrxusa.com/# discount pharmacy

stromectol pill: stromectol 6 mg tablet – Iver Therapeutics

zoloft pill: zoloft buy – sertraline

https://neuroreliefusa.com/# generic neurontin 300 mg

sertraline zoloft medication generic zoloft

http://sertralineusa.com/# zoloft pill

neurontin 300mg capsule: Neuro Relief USA – neurontin without prescription

https://neuroreliefusa.shop/# Neuro Relief USA

zoloft generic: zoloft tablet – zoloft pill

https://smartgenrxusa.shop/# Smart GenRx USA

ivermectin 500mg: Iver Therapeutics – Iver Therapeutics

Neuro Relief USA: Neuro Relief USA – neurontin tablets 100mg

https://sertralineusa.com/# sertraline generic

zoloft generic Sertraline USA zoloft buy

http://smartgenrxusa.com/# Smart GenRx USA

Neuro Relief USA: Neuro Relief USA – Neuro Relief USA

zoloft cheap: order zoloft – generic zoloft

https://sertralineusa.com/# generic for zoloft

800mg neurontin: neurontin canada – Neuro Relief USA

https://sertralineusa.com/# sertraline generic

Iver Therapeutics: Iver Therapeutics – buy ivermectin pills

generic for zoloft zoloft without dr prescription zoloft without dr prescription

zoloft medication: generic zoloft – zoloft without rx

https://ivertherapeutics.com/# ivermectin drug

https://ivertherapeutics.shop/# Iver Therapeutics

https://sertralineusa.com/# zoloft no prescription

Iver Therapeutics: ivermectin 200mg – stromectol order

Iver Therapeutics: Iver Therapeutics – stromectol pill

http://smartgenrxusa.com/# which online pharmacy is reliable

Smart GenRx USA: Smart GenRx USA – Smart GenRx USA

Iver Therapeutics: stromectol order online – Iver Therapeutics

https://ivertherapeutics.shop/# Iver Therapeutics

stromectol in canada: Iver Therapeutics – stromectol uk buy

http://neuroreliefusa.com/# Neuro Relief USA

neurontin 300 mg mexico: neurontin 100mg caps – Neuro Relief USA

zoloft tablet: zoloft without dr prescription – zoloft generic

https://sertralineusa.com/# sertraline zoloft

Neuro Relief USA: neurontin 400 mg – Neuro Relief USA

Iver Therapeutics: ivermectin 8000 – Iver Therapeutics

Smart GenRx USA Smart GenRx USA Smart GenRx USA

https://ivertherapeutics.com/# ivermectin

sertraline zoloft: buy zoloft – generic zoloft

https://sertralineusa.shop/# sertraline zoloft

zoloft without dr prescription: zoloft no prescription – zoloft pill

https://sertralineusa.com/# zoloft without rx

Smart GenRx USA: pharmacy rx – online pharmacy ordering

Neuro Relief USA: neurontin cost uk – Neuro Relief USA

http://smartgenrxusa.com/# onlinecanadianpharmacy

ivermectin 3 mg tabs: Iver Therapeutics – Iver Therapeutics

http://ivertherapeutics.com/# Iver Therapeutics

gold pharmacy online: pharmacy online 365 discount code – Smart GenRx USA

stromectol ivermectin buy: stromectol where to buy – stromectol price us

http://neuroreliefusa.com/# buy brand neurontin

https://smartgenrxusa.com/# Smart GenRx USA

Neuro Relief USA: Neuro Relief USA – neurontin 300 mg caps

Iver Therapeutics ivermectin 12 mg stromectol order online

https://ivertherapeutics.com/# Iver Therapeutics

zoloft buy: zoloft medication – zoloft without rx

Smart GenRx USA: Smart GenRx USA – Smart GenRx USA

https://neuroreliefusa.shop/# Neuro Relief USA

neurontin 204: Neuro Relief USA – neurontin cream

can you buy stromectol over the counter: Iver Therapeutics – Iver Therapeutics

http://ivertherapeutics.com/# generic stromectol

https://sertralineusa.shop/# generic for zoloft

Smart GenRx USA Smart GenRx USA Smart GenRx USA

sertraline: sertraline zoloft – zoloft no prescription

https://sertralineusa.com/# generic zoloft

Smart GenRx USA: bitcoin pharmacy online – Smart GenRx USA

Smart GenRx USA: Smart GenRx USA – Smart GenRx USA

https://neuroreliefusa.shop/# Neuro Relief USA

https://sertralineusa.shop/# zoloft cheap

neurontin cost in singapore: Neuro Relief USA – Neuro Relief USA

zoloft tablet: zoloft no prescription – generic for zoloft

https://smartgenrxusa.com/# Smart GenRx USA

Iver Therapeutics stromectol usa stromectol pills

https://ivertherapeutics.com/# ivermectin cost

Smart GenRx USA: online pharmacy no rx – professional pharmacy

Smart GenRx USA: Smart GenRx USA – canada drug pharmacy

https://smartgenrxusa.com/# Smart GenRx USA

stromectol 3mg tablets: Iver Therapeutics – stromectol tablets uk

neurontin 100mg capsule price: neurontin 300 mg caps – ordering neurontin online

https://sertralineusa.com/# sertraline

ivermectin where to buy for humans Iver Therapeutics ivermectin buy online

Smart GenRx USA: pharmacy – us pharmacy

https://sertralineusa.shop/# zoloft buy

Neuro Relief USA: Neuro Relief USA – neurontin medicine

zoloft without rx: sertraline – zoloft cheap

http://smartgenrxusa.com/# pill pharmacy

http://neuroreliefusa.com/# Neuro Relief USA

Sertraline USA: generic zoloft – zoloft tablet

best canadian pharmacy: trustworthy online pharmacy – Smart GenRx USA

https://smartgenrxusa.com/# Smart GenRx USA

generic for zoloft zoloft without rx sertraline

Smart GenRx USA: discount pharmacy – Smart GenRx USA

https://sertralineusa.shop/# zoloft without dr prescription

https://ivertherapeutics.shop/# Iver Therapeutics

Neuro Relief USA: neurontin 600 mg pill – Neuro Relief USA

Neuro Relief USA: Neuro Relief USA – Neuro Relief USA

https://ivertherapeutics.shop/# Iver Therapeutics

cost of ivermectin: Iver Therapeutics – Iver Therapeutics

Smart GenRx USA: Smart GenRx USA – Smart GenRx USA

buying neurontin without a prescription Neuro Relief USA Neuro Relief USA

http://neuroreliefusa.com/# neurontin brand name 800mg

https://ivertherapeutics.shop/# Iver Therapeutics

generic zoloft: order zoloft – sertraline zoloft

http://ivertherapeutics.com/# buy ivermectin pills

sertraline zoloft: zoloft buy – zoloft no prescription

http://neuroreliefusa.com/# Neuro Relief USA

order zoloft: generic for zoloft – Sertraline USA

buy neurontin uk: Neuro Relief USA – Neuro Relief USA

https://neuroreliefusa.shop/# neurontin oral

Neuro Relief USA Neuro Relief USA neurontin 600 mg cost

https://neuroreliefusa.shop/# Neuro Relief USA

neurontin 100mg tablet: neurontin 800 mg pill – medicine neurontin 300 mg

neurontin cap 300mg price: Neuro Relief USA – Neuro Relief USA

https://sertralineusa.com/# zoloft without rx

Neuro Relief USA: neurontin 400 mg – neurontin 300 mg tablet

http://ivertherapeutics.com/# ivermectin topical

http://sertralineusa.com/# buy zoloft

Smart GenRx USA: Smart GenRx USA – Smart GenRx USA

generic for zoloft: zoloft without rx – sertraline

sertraline zoloft zoloft tablet generic zoloft

https://neuroreliefusa.shop/# neurontin 400 mg capsules

Iver Therapeutics: Iver Therapeutics – ivermectin 1 cream 45gm

http://sertralineusa.com/# order zoloft

https://ivertherapeutics.shop/# Iver Therapeutics

Neuro Relief USA: buy gabapentin online – neurontin 900

https://smartgenrxusa.com/# canadian pharmacy victoza

Iver Therapeutics: Iver Therapeutics – how much does ivermectin cost

Neuro Relief USA gabapentin Neuro Relief USA

Iver Therapeutics: Iver Therapeutics – Iver Therapeutics

https://ivertherapeutics.shop/# Iver Therapeutics

canadian family pharmacy: canadian pharmacy world coupons – indian pharmacy

https://neuroreliefusa.com/# neurontin 300mg caps

neurontin cap: Neuro Relief USA – medication neurontin 300 mg

https://smartgenrxusa.com/# canadian drugs pharmacy

https://smartgenrxusa.shop/# Smart GenRx USA

no rx pharmacy: Smart GenRx USA – Smart GenRx USA

zoloft generic: zoloft tablet – order zoloft

Iver Therapeutics Iver Therapeutics Iver Therapeutics

https://neuroreliefusa.shop/# neurontin 1200 mg

neurontin cost uk: Neuro Relief USA – buying neurontin without a prescription

Iver Therapeutics: Iver Therapeutics – Iver Therapeutics

https://smartgenrxusa.com/# pharmacy website india

http://sertralineusa.com/# sertraline generic

usa pharmacy: online pharmacy europe – Smart GenRx USA

CertiCanPharmacy: legitimate canadian pharmacies – trusted canadian pharmacy

pet pharmacy: vet pharmacy online – vet pharmacy online

https://vetfreemeds.com/# pet meds for dogs

my canadian pharmacy review canadian drugstore online CertiCanPharmacy

https://vetfreemeds.shop/# pet prescriptions online

mexico pharmacy: mexican pharmacy that ships to the us – best mexican pharmacy online

http://mymexicanpharmacy.com/# My Mexican Pharmacy

canada pet meds: pet rx – pet pharmacy

https://certicanpharmacy.com/# onlinecanadianpharmacy

canadian neighbor pharmacy: CertiCanPharmacy – legitimate canadian pharmacy online

http://mymexicanpharmacy.com/# purple pharmacy mexico

mexican mail order pharmacy My Mexican Pharmacy mexico pharmacy list

https://certicanpharmacy.com/# northern pharmacy canada

pet meds official website: VetFree Meds – pet rx

canadian king pharmacy: CertiCanPharmacy – online canadian pharmacy review

https://vetfreemeds.shop/# pet pharmacy online

https://certicanpharmacy.com/# canadapharmacyonline legit

adderall canadian pharmacy: 77 canadian pharmacy – northwest pharmacy canada

https://mymexicanpharmacy.com/# order antibiotics from mexico

canadian pharmacies compare canadian pharmacy 24 buy drugs from canada

https://mymexicanpharmacy.shop/# My Mexican Pharmacy

My Mexican Pharmacy: mexico pharmacy list – My Mexican Pharmacy

pet pharmacy: dog prescriptions online – pet drugs online

http://mymexicanpharmacy.com/# My Mexican Pharmacy

http://certicanpharmacy.com/# CertiCanPharmacy

trusted canadian pharmacy: CertiCanPharmacy – CertiCanPharmacy

buying prescription drugs in mexico: pharmacies in mexico that ship to the us – My Mexican Pharmacy

http://certicanpharmacy.com/# CertiCanPharmacy

http://vetfreemeds.com/# pet pharmacy

CertiCanPharmacy CertiCanPharmacy CertiCanPharmacy

pet prescriptions online: VetFree Meds – discount pet meds

can i order online from a mexican pharmacy: My Mexican Pharmacy – prescriptions from mexico

http://mymexicanpharmacy.com/# meds from mexico

http://vetfreemeds.com/# vet pharmacy online

CertiCanPharmacy: best canadian online pharmacy – CertiCanPharmacy

pet pharmacy: VetFree Meds – dog prescriptions online

http://certicanpharmacy.com/# reliable canadian pharmacy

http://vetfreemeds.com/# pet meds online

pet meds online VetFree Meds п»їdog medication online

CertiCanPharmacy: CertiCanPharmacy – best canadian online pharmacy

https://vetfreemeds.com/# pet meds for dogs

pet pharmacy: VetFree Meds – discount pet meds

https://vetfreemeds.shop/# discount pet meds

vet pharmacy: vet pharmacy – best pet rx

https://vetfreemeds.com/# pet meds official website

maple leaf pharmacy in canada: CertiCanPharmacy – pharmacy canadian

CertiCanPharmacy: certified canadian international pharmacy – canada drugs online

https://certicanpharmacy.com/# legitimate canadian pharmacy

https://vetfreemeds.com/# dog prescriptions online

purple pharmacy online ordering: My Mexican Pharmacy – My Mexican Pharmacy

https://mymexicanpharmacy.shop/# pharmacys in mexico

https://vetfreemeds.shop/# online pet pharmacy

online vet pharmacy: VetFree Meds – pet meds for dogs